filmov

tv

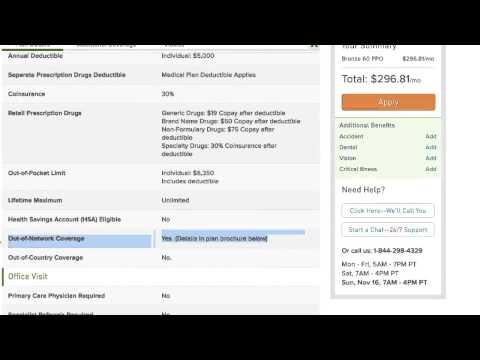

How does an out of pocket maximum limit work on a health insurance policy?

Показать описание

🏥 Understanding Out-of-Pocket Maximums in Health Insurance 🏥

👋 We know health insurance can be confusing, so we're here to shed some light on a critical aspect of it: the Out-of-Pocket Maximum! 🌟

🤔 What is it?

Think of the Out-of-Pocket Maximum as a safety net for your healthcare costs. It's the maximum amount you'll have to pay for covered medical services in a single year. Once you hit this limit, your insurance plan steps in to cover all the costs for covered medical expenses for the rest of the year. Phew, right? 😅

💡 Why is it important?

Having an Out-of-Pocket Maximum is super beneficial because it sets a cap on the amount you'll need to pay from your pocket. So if you ever face unexpected health expenses, you won't have to worry about an endless pile of bills.

💸 What goes towards it?

Several costs count towards meeting your Out-of-Pocket Maximum:

1️⃣ Deductible: This is the initial amount you pay for covered medical services before your insurance kicks in. Any payments you make towards your deductible also go towards your Out-of-Pocket Maximum.

2️⃣ Coinsurance: After you meet your deductible, you may still owe a percentage of the medical bill while your insurance covers the rest. These payments also count towards your Out-of-Pocket Maximum.

3️⃣ Copayment: Unlike coinsurance, copayments are fixed amounts you pay for certain medical services at the time of your visit. Yep, these count too!

🚫 What doesn't count?

Some costs don't go towards your Out-of-Pocket Maximum:

1️⃣ Premiums: Your monthly premiums for the health insurance plan don't count towards the maximum. You'll keep paying your premiums throughout the year unless you cancel the plan.

2️⃣ Non-Covered Services: If a medical service isn't covered by your insurance, any expenses related to it won't contribute to your Out-of-Pocket Maximum.

3️⃣ Balance Billing: If your healthcare provider charges more than your insurance's allowed amount, any extra payment you make won't count towards the maximum.

✅ Once you reach the limit:

Good news! When you hit your Out-of-Pocket Maximum, you won't have to worry about further cost sharing, like copayments or coinsurance, for the rest of the year. Your insurance will cover 100% of the covered medical expenses.

Always check your policy to know your specific Out-of-Pocket Maximum and stay informed! If you have any questions, feel free to ask. We're here to help you navigate your health insurance journey! 🚀

#healthinsurance #obamacare #coveredca

#taxcredits #coveredca #healthinsurance #healthcare

--------

Would You Help Spread The Word?

We work hard to provide you with this content for free, day after day. If you’d like to do something to help, we’d love it if you could spread the word about Let’s Talk Money Channel!

1. Like this video and share it on your favorite social media platform, or send it to a friend who might benefit from this information.

👋 We know health insurance can be confusing, so we're here to shed some light on a critical aspect of it: the Out-of-Pocket Maximum! 🌟

🤔 What is it?

Think of the Out-of-Pocket Maximum as a safety net for your healthcare costs. It's the maximum amount you'll have to pay for covered medical services in a single year. Once you hit this limit, your insurance plan steps in to cover all the costs for covered medical expenses for the rest of the year. Phew, right? 😅

💡 Why is it important?

Having an Out-of-Pocket Maximum is super beneficial because it sets a cap on the amount you'll need to pay from your pocket. So if you ever face unexpected health expenses, you won't have to worry about an endless pile of bills.

💸 What goes towards it?

Several costs count towards meeting your Out-of-Pocket Maximum:

1️⃣ Deductible: This is the initial amount you pay for covered medical services before your insurance kicks in. Any payments you make towards your deductible also go towards your Out-of-Pocket Maximum.

2️⃣ Coinsurance: After you meet your deductible, you may still owe a percentage of the medical bill while your insurance covers the rest. These payments also count towards your Out-of-Pocket Maximum.

3️⃣ Copayment: Unlike coinsurance, copayments are fixed amounts you pay for certain medical services at the time of your visit. Yep, these count too!

🚫 What doesn't count?

Some costs don't go towards your Out-of-Pocket Maximum:

1️⃣ Premiums: Your monthly premiums for the health insurance plan don't count towards the maximum. You'll keep paying your premiums throughout the year unless you cancel the plan.

2️⃣ Non-Covered Services: If a medical service isn't covered by your insurance, any expenses related to it won't contribute to your Out-of-Pocket Maximum.

3️⃣ Balance Billing: If your healthcare provider charges more than your insurance's allowed amount, any extra payment you make won't count towards the maximum.

✅ Once you reach the limit:

Good news! When you hit your Out-of-Pocket Maximum, you won't have to worry about further cost sharing, like copayments or coinsurance, for the rest of the year. Your insurance will cover 100% of the covered medical expenses.

Always check your policy to know your specific Out-of-Pocket Maximum and stay informed! If you have any questions, feel free to ask. We're here to help you navigate your health insurance journey! 🚀

#healthinsurance #obamacare #coveredca

#taxcredits #coveredca #healthinsurance #healthcare

--------

Would You Help Spread The Word?

We work hard to provide you with this content for free, day after day. If you’d like to do something to help, we’d love it if you could spread the word about Let’s Talk Money Channel!

1. Like this video and share it on your favorite social media platform, or send it to a friend who might benefit from this information.

Комментарии

0:11:42

0:11:42

0:00:26

0:00:26

0:17:17

0:17:17

0:02:44

0:02:44

0:16:06

0:16:06

0:09:48

0:09:48

0:00:59

0:00:59

0:21:13

0:21:13

0:02:46

0:02:46

0:06:26

0:06:26

0:00:51

0:00:51

0:09:32

0:09:32

0:18:52

0:18:52

0:11:30

0:11:30

0:35:27

0:35:27

0:00:15

0:00:15

0:34:46

0:34:46

0:02:07

0:02:07

0:00:59

0:00:59

0:02:11

0:02:11

0:10:05

0:10:05

0:05:39

0:05:39

0:00:39

0:00:39

0:04:28

0:04:28