filmov

tv

Explained: Different LLC Tax Classifications And Their Advantages

Показать описание

If you’re an entrepreneur who needs to know the first steps to starting your own business for the first time, you need to watch this video. Here, you’ll learn three things: first, you’ll learn about the five different types of LLC tax classification for businesses, second, you’ll learn the unique advantages of filing as an S corporation, and finally, you’ll learn how to make the best decision possible to start a small business LLC with the appropriate corporate structure. This makes a big difference when filing LLC taxes.

A limited liability company (LLC) is one of the most common types of business entities around. Despite their popularity as a business structure, limited liability companies do not have their own tax classification. Depending on how many members are in the LLC, your business can be taxed in different ways. As a business owner, this could drastically change how much taxable income you have at the end of the year. In this post, we will cover the different LLC tax classification options you can choose from.

Disclaimer: Not advice. For educational or informational purposes only. Use at your own risk.

A limited liability company (LLC) is one of the most common types of business entities around. Despite their popularity as a business structure, limited liability companies do not have their own tax classification. Depending on how many members are in the LLC, your business can be taxed in different ways. As a business owner, this could drastically change how much taxable income you have at the end of the year. In this post, we will cover the different LLC tax classification options you can choose from.

Disclaimer: Not advice. For educational or informational purposes only. Use at your own risk.

Explained: Different LLC Tax Classifications And Their Advantages

Tax Differences EXPLAINED: LLC, S Corp, Partnership, Sole Prop

CPA EXPLAINS Tax Differences: LLC, S Corp, C Corp, Partnership, Sole Prop

Legal Entity vs. Tax Classification | Understand the Difference

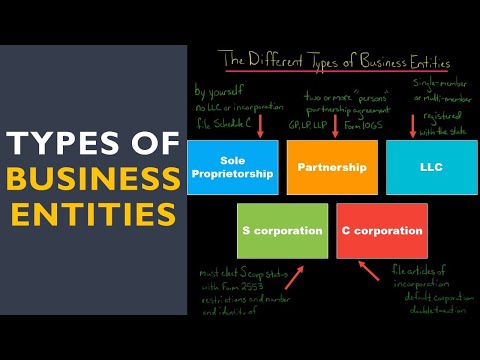

The Different Types of Business Entities in the U.S.

Business Structure - How to Choose the Right Structure for your Business

LLC vs S Corp: Tax Benefits, Differences, & Strategies 2024

Lesson 1 | S-Corp Bootcamp | Legal Business Structures, Tax Classifications, and What to Know!

3 reasons why USA LLCs are no longer safe in 2025

Sole Prop, LLC, S Corp, C Corp & Partnership | Legal & Tax Differences EXPLAINED

Form 2553 or 8832 | LLC, S Corp, Partnership, C Corp Tax Elections

Single Member LLC: What You Need to Know This Tax Season (2024)

How To Pay Yourself (And Taxes) in a Single Member LLC

How to Lower Your Taxes with an LLC [Best Tax Strategy for LLC Owners]

Sole Proprietor vs. LLC vs. S Corporation vs. C Corporation | Legal & Tax Differences

S Corp vs. C Corp Tax Differences EXPLAINED

Tax Benefits of Using an LLC Taxed as an S Corp - Sherman the CPA

Single Member vs. Multi Member LLC Default Tax Rules | Attorney Explains

S Corp vs Partnership [LLC or Not] Tax Basis Form 1120s vs Form 1065 [Limited Liability Company]

LLC Taxes & Tax Benefits EXPLAINED By A CPA - How Does An LLC SAVE Taxes?

LLC vs S Corp‼️#shorts #taxes #entrepreneur #tax #businessowner #llc #smallbusiness #taxfree

LLC [Tax] Strategy for Real Estate Commercial & Residential Investors [Limited Liability Company...

LLC Partnership Tax Basis & Basics: Form 1065, Sch K-1, Capital Account, Inside Basis, Outside B...

Sole Proprietorship vs LLC: Tax Savings Example

Комментарии

0:05:10

0:05:10

0:28:06

0:28:06

0:18:16

0:18:16

0:08:11

0:08:11

0:08:11

0:08:11

0:06:30

0:06:30

0:15:27

0:15:27

0:28:01

0:28:01

0:09:16

0:09:16

0:35:33

0:35:33

0:07:14

0:07:14

0:12:32

0:12:32

0:09:59

0:09:59

0:09:11

0:09:11

0:12:43

0:12:43

0:12:21

0:12:21

0:08:16

0:08:16

0:00:59

0:00:59

0:07:31

0:07:31

0:38:01

0:38:01

0:00:25

0:00:25

![LLC [Tax] Strategy](https://i.ytimg.com/vi/gBDd6_U5nQM/hqdefault.jpg) 0:21:25

0:21:25

0:19:59

0:19:59

0:13:43

0:13:43