filmov

tv

WILL SOCIAL SOLIDARITY BE THE ANSWER FOR LOAN RECOVERY DUE TO COVID 19 DEFAULTS?

Показать описание

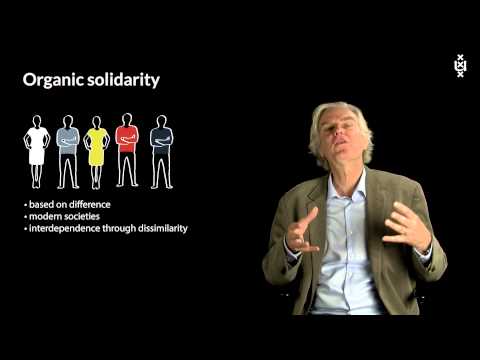

(Reading time 3 minutes) How many personal and consumer loans in default does your bank, cooperative or microfinance company has since 2020?, How many defaulted credits have been modified? How many readjusted loans fell into default again? and What solution that has been applied has totally reduce the future defaults of the loans given before the CoVid-19?. Many minority debtors of consumer loans, personal loans, credit cards and in some cases microcredits are facing serious defaults in their loans due to the CoVid-19 pandemic. The traditional solutions of refinancing or restructuring debts by lengthening the term to reduce the installments and even reducing also the interest of the loans during a limited period, but this do not seem to solve the default of the debtors who: Due to unemployment and the lack of jobs in their countries, they have seen themselves in the need to suspend the payment of the loan installments to lengthen their savings and their unemployment benefits for working time to survive this crisis. This video contains the ideas of José Linares Fontela, International Consultant, to stop the default on loans granted before CoVid-19 based on the support of the family and the social environment of the debtor in default for a period that will allow them to recover economically. These ideas in the video are based on the professional experience of José Linares Fontela on marketing, sales, credits and collections in 27 countries applied since 1999 and in times of crisis, now customized to the economic effect after CoVid-19 (El Pos-CoVid-19). The video can also be used to promote webinars to convey these innovative and creative experiences to develop effective and durable loan recovery solutions in the short and medium term based in the community and social support

0:02:11

0:02:11

0:09:50

0:09:50

0:03:11

0:03:11

0:05:09

0:05:09

0:24:06

0:24:06

0:03:40

0:03:40

0:06:26

0:06:26

1:29:33

1:29:33

0:51:17

0:51:17

0:32:37

0:32:37

0:15:43

0:15:43

0:01:00

0:01:00

0:08:35

0:08:35

1:04:35

1:04:35

0:01:00

0:01:00

0:04:41

0:04:41

0:08:56

0:08:56

0:29:23

0:29:23

0:57:58

0:57:58

0:02:46

0:02:46

0:06:35

0:06:35

0:02:12

0:02:12

0:23:03

0:23:03

0:00:59

0:00:59