filmov

tv

Ray Dalio's Advice As The Markets Are CRASHING

Показать описание

Join Our Exclusive Community, Get Buy/Sell Alerts For My Personal Portfolio, And Loads More:

Invest In Fractional Ownership Of Fine Art From World Famous Artists:

Invest In Crypto Through Your IRA And Save Thousands:

Check Out These Other Sites For Free Crypto And Great Opportunities:

Follow & Subscribe To Our Other Platforms Here!

DISCLAIMERS:

I am not a financial advisor and this is not a financial advice channel. All information is provided strictly for educational purposes. It does not take into account anybody's specific circumstances or situation. If you are making investment or other financial management decisions and require advice, please consult a suitably qualified licensed professional.

Invest In Fractional Ownership Of Fine Art From World Famous Artists:

Invest In Crypto Through Your IRA And Save Thousands:

Check Out These Other Sites For Free Crypto And Great Opportunities:

Follow & Subscribe To Our Other Platforms Here!

DISCLAIMERS:

I am not a financial advisor and this is not a financial advice channel. All information is provided strictly for educational purposes. It does not take into account anybody's specific circumstances or situation. If you are making investment or other financial management decisions and require advice, please consult a suitably qualified licensed professional.

My Advice to People in Their 40s and 50s

Ray Dalio breaks down his 'Holy Grail'

Ray Dalio’s Best Advice for Young Entrepreneurs

THE MINDSET OF A BILLIONAIRE - Ray Dalio Billionaire Investors Advice

Principles For Success by Ray Dalio (In 30 Minutes)

RAY DALIO: Gold isn't a good Investment

Ray Dalio: Diversification is NOT for Idiots

MY ADVICE TO YOUNG PEOPLE - Ray Dalio

'Start PREPARING Yourself...' - Ray Dalio

Ray Dalio’s Investment Philosophy

Principles for Dealing with the Changing World Order by Ray Dalio

Billionaire Ray Dalio: I only do what excites me

Ray Dalio: Anybody Can Succeed in the Market

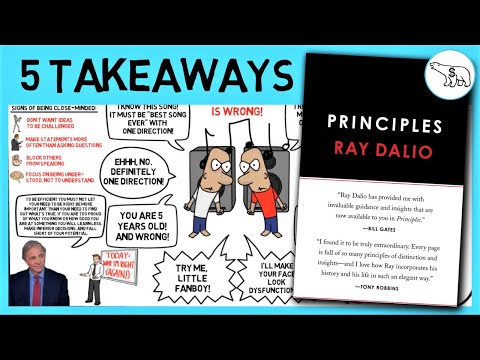

PRINCIPLES: LIFE AND WORK (BY RAY DALIO)

Ray Dalio's Advice To Abrab Sheikh In his 30's

10 Key Ideas by Ray Dalio

🚨Ray Dalio: Prepare NOW! This Is A HUGE Problem For Us ALL (MUST Own Gold🪙).

Ray Dalio Reveals His True Thoughts On Bitcoin

Ray Dalio’s Principles of Investing in a Changing World | WSJ News

How The Economic Machine Works by Ray Dalio

Ray Dalio: Investing Advice for 2021

The Billionaire Mindset - Ray Dalio's Investor Advice on The Power of Mindset

'I Tried To Warn You' - Ray Dalio's LAST WARNING

Ray Dalio gives 3 financial recommendations for millennials

Комментарии

0:02:26

0:02:26

0:04:44

0:04:44

0:01:22

0:01:22

0:11:46

0:11:46

0:28:47

0:28:47

0:00:54

0:00:54

0:08:01

0:08:01

0:00:32

0:00:32

0:13:01

0:13:01

0:03:42

0:03:42

0:43:43

0:43:43

0:05:25

0:05:25

0:03:41

0:03:41

0:15:14

0:15:14

0:03:32

0:03:32

0:04:53

0:04:53

0:12:47

0:12:47

0:09:58

0:09:58

0:25:20

0:25:20

0:31:00

0:31:00

0:13:12

0:13:12

0:08:46

0:08:46

0:33:37

0:33:37

0:09:29

0:09:29