filmov

tv

How Dividends Are Taxed in Canada | How to Live off Dividends Tax Free

Показать описание

Canadian dividend-paying stocks give you a hefty tax break when you hold them outside of your tax-sheltered accounts like the TFSA, RRSP, FHSA, RRIF to name a few.

💰 FREE MONEY - STOCKS & CRYPTO:

😎 INVESTOR SUPPORT:

✅ SPECIAL OFFERS:

📚 BEST PERSONAL FINANCE BOOKS:

🛒 MY GEAR:

******

WATCH NEXT:

▶ Top 5 HUGE Tax Deductions for Tax Return in Canada | Maximize Tax Refund

▶ CPA EXPLAINS Important TAX CHANGES in CANADA for 2024 | TFSA, RRSP, FHSA, CPP & Tax Brackets

******

0:00 Why do you receive Dividend Tax Credit?

3:36 Calculating Dividend Income With Gross-Up

4:30 Dividend Tax Credit Examples

8:20 How to save on Taxes with Dividend Tax Credit

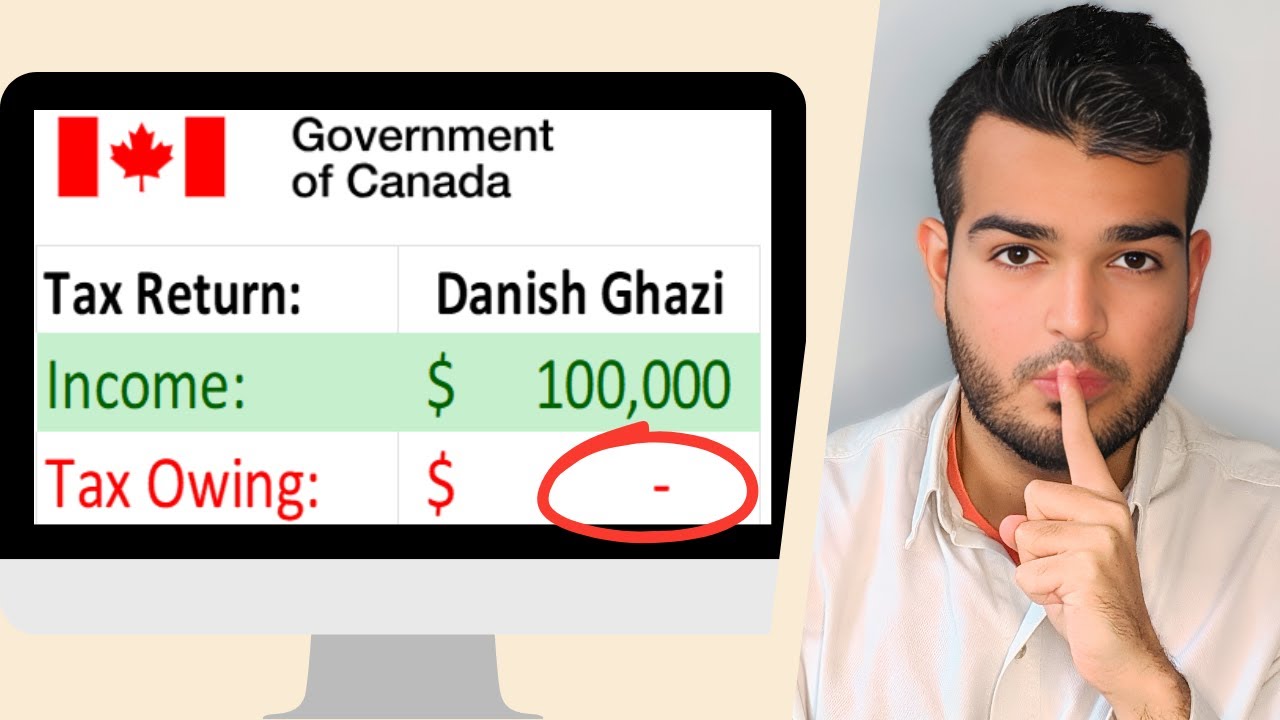

Imagine earning $1,000 in dividends and paying less taxes on everything else. Sounds too good to be true, right? Well, that’s exactly what happens if you earn $25,000 a year in Canada. You pay zero tax on your dividend income, and you even get a tax break on your other income. This is called a negative marginal tax rate, and it’s a dream come true for any accountant. Compared to interest income, you save $240 in taxes by earning dividends.

The government recognizes that it’s unfair to tax the same income twice. So they give you a break on dividend taxes to offset the taxes the corporation already paid. As a result, you should pay roughly the same tax as if the income had come straight to you in the first place, without passing through corporate hands.

Do you know the difference between eligible and other than eligible dividends in Canada? If you own shares of Canadian corporations, you may receive dividends from them. But not all dividends are created equal. Depending on the type of dividend, you may pay taxes on your personal tax return. In this video, I will explain how each dividend type affects your taxes, and how you can take advantage of the dividend tax credit to reduce your tax bill. Whether you are a beginner or an expert investor, this video will help you understand the tax implications of dividend income in Canada.

Eligible Dividends: The corporation must designate the dividends as “eligible” which means that they paid higher tax rates. In return, you will pay more taxes and receive a higher tax credit.

Other Than Eligible Dividends: The corporation must designate the dividends as ‘other than eligible” which means that they paid lower tax rates. In return, you will pay less taxes and receive a smaller tax credit.

Disclaimer: This channel is for education purposes only and opinions expressed in this video are based on personal research and should be treated as such. These are not instructions, suggestions, nor directions as to how to handle your money. The facts and figures presented in this video are up-to-date based on the recording. These may have changed based on when you watch the video, please, always do your own due diligence!

#taxesincanada #canadafinance #taxplanningstrategies

Комментарии

0:04:53

0:04:53

0:10:06

0:10:06

0:14:15

0:14:15

0:00:18

0:00:18

0:01:57

0:01:57

0:06:28

0:06:28

0:07:09

0:07:09

0:11:57

0:11:57

0:11:32

0:11:32

0:00:48

0:00:48

0:09:21

0:09:21

0:01:35

0:01:35

0:00:17

0:00:17

0:08:34

0:08:34

0:15:33

0:15:33

0:06:19

0:06:19

0:05:30

0:05:30

0:15:21

0:15:21

0:00:29

0:00:29

0:00:40

0:00:40

0:00:41

0:00:41

0:00:55

0:00:55

0:13:47

0:13:47

0:05:46

0:05:46