filmov

tv

Disposal Of Fixed Assets : Selling Fixed Assets ( calculate gain or loss)

Показать описание

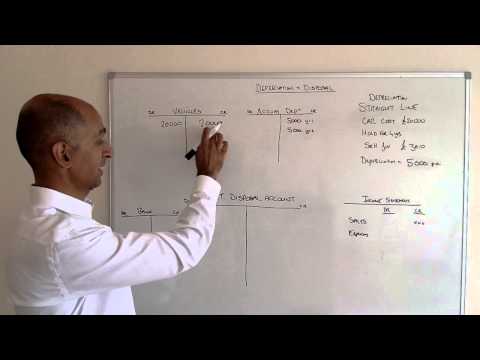

There are 3 ways to dispose of the fixed assets :

1. Discard

2. Sell

3. Exchange or trade in

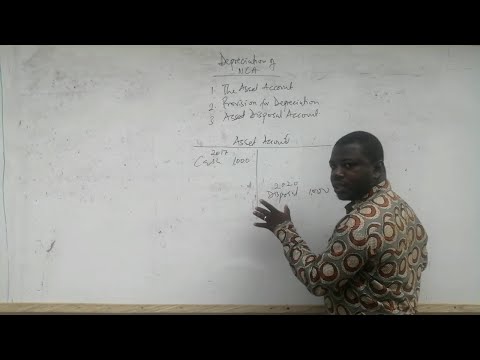

When the company want to sell the fixed assets, the company will calculate gain or loss .

the company will calculate book value to compare with cash received of disposal of fixed assets.

Book value = cost - accumulated depreciation

After that , we must compare book value with cash received :

1. cash received is bigger than book value = gain on disposal

2. book value is bigger than cash received = loss on disposal

1. Discard

2. Sell

3. Exchange or trade in

When the company want to sell the fixed assets, the company will calculate gain or loss .

the company will calculate book value to compare with cash received of disposal of fixed assets.

Book value = cost - accumulated depreciation

After that , we must compare book value with cash received :

1. cash received is bigger than book value = gain on disposal

2. book value is bigger than cash received = loss on disposal

0:07:18

0:07:18

0:05:30

0:05:30

0:09:15

0:09:15

0:05:23

0:05:23

0:07:35

0:07:35

0:03:29

0:03:29

0:14:10

0:14:10

0:02:40

0:02:40

0:09:15

0:09:15

0:06:06

0:06:06

0:08:41

0:08:41

0:12:11

0:12:11

0:11:01

0:11:01

0:01:30

0:01:30

0:06:05

0:06:05

0:07:35

0:07:35

0:27:15

0:27:15

1:00:10

1:00:10

0:10:55

0:10:55

0:06:03

0:06:03

0:11:41

0:11:41

0:01:00

0:01:00

0:16:26

0:16:26

0:30:59

0:30:59