filmov

tv

Here's what to do now that we got that rate hike

Показать описание

This is how you have to trade the market in the aftermath of yesterday's Fed rate hike.

How We Got Here, And What To Do Now!

Here's what to do with your yard signs now that the election is over

Here She Comes Now (Demo)

My Mom Is Jealous Of Me Because I Look Like A Model

Lil Peep - right here (feat. Horse Head) (Official Audio)

Immigrants Are Taking Over Pennsylvania Now. Everyone Here Is Freaking Out.

My Dad Disowned Me Because Of My TikTok

IT’S HERE! “Barbie & Ken” from @scenequeenrocks & @SetItOff is out now 💖

Jamie Miller - Here's Your Perfect (with salem ilese) [Official Music Video]

Jamie Miller - Here's Your Perfect (Official Music Video)

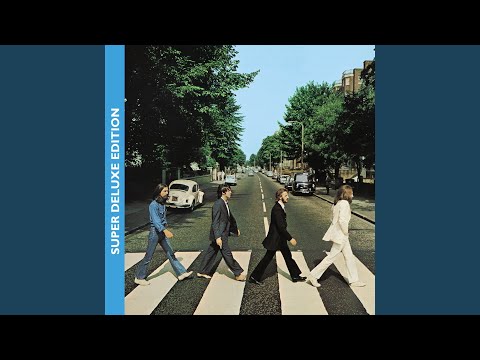

Here Comes The Sun (2019 Mix)

My Mom Buys My Spoiled Sister Everything She Wants. What Goes Wrong?

Now United - The Weekend's Here (Official Girls Trip Video)

Paul McCartney - Here Today (Music Video)

Staind - Here And Now (Official Music Video)

Heres to now - Ugly casanova

Magnet Power! Making Awesome INFINITY GAUNTLET

Here's To Now

Subscriptions Are Ruining Our Lives. Here's Why They're Everywhere Now.

Gët Busy [Official Music Video]

'I Told You Something is Coming & Now It's Here...' | Victor Davis Hanson

Marco Rubio on goal to end Ukraine war during Trump's 2nd term

Why is Justin Bieber being attacked right now? Here is what I think...

Here today and Gone Tomorrow by Ray Conniff with Lyrics 26

Комментарии

0:10:47

0:10:47

0:00:56

0:00:56

0:05:01

0:05:01

0:09:58

0:09:58

0:02:57

0:02:57

1:00:37

1:00:37

0:10:27

0:10:27

0:00:16

0:00:16

0:02:49

0:02:49

0:02:50

0:02:50

0:03:06

0:03:06

0:10:23

0:10:23

0:02:53

0:02:53

0:02:26

0:02:26

0:03:58

0:03:58

0:02:52

0:02:52

0:04:33

0:04:33

0:02:52

0:02:52

0:16:45

0:16:45

0:02:44

0:02:44

0:08:55

0:08:55

0:05:14

0:05:14

0:01:00

0:01:00

0:02:57

0:02:57