filmov

tv

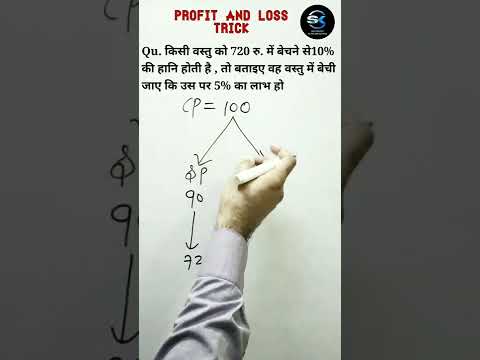

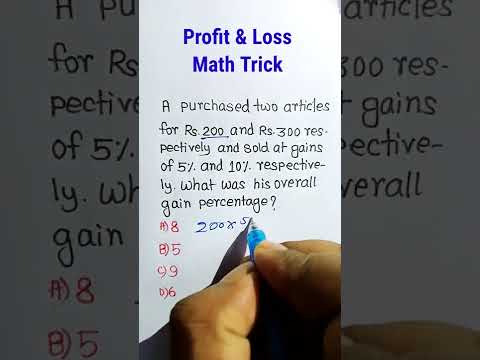

Profit and Loss Basics maths class 5 6 7 8 9 10 trick shortcuts online videos cbse ncert

Показать описание

Profit and Loss Basics maths class 5 6 7 8 9 10 trick shortcuts online videos cbse ncert

profit and loss basics,

profit and loss definition,

formula of profit and loss,

purpose of profit and loss account,

statement of profit and loss format,

profit and loss problems,

Profit and loss,

How can calculate profit and loss?,

profit and loss basics concepts,

percentage profit and loss basics,

maths aptitude shortcuts,

maths activity for class 8,

cbse ncert cisce nios ICSE wbsc WBBSE IB bse igcse icsce aisse hslc aicte mpbse isc sslc jkbose jksbse cce hbse matric GSHSEB isc state board scert nenbse seba cgbse samacheer

online school videos and lectures

Higher secondary school

Andhra Pradesh Secondary Intermediate

Bihar School Intermediate

Meghalaya Mizoram Nagaland Odisha Assam Kerala Madhya Pradesh

Maharashtra Manipur Higher Secondary

Council for the Indian School Certificate Examinations

the Central Board for Secondary Education

the National Institute of Open Schooling

Pre-primary

Primary

Middle/ upper-primary

Senior secondary

inter college

Board of Secondary Education maths

CBSE Maths

JEE MAIN Exam

JEE Advanced Exam (IIT-JEE )

Kerala KEAM

VITEEE

BITSAT Entrance Exam

Manipal University Online Entrance Test

Amrita Engineering Entrance Examination AEEE

SRMJEEE - SRM Engineering Entrance Examination

Telangana EAMT

AccuPlacer

ACT

ALEKS College Algebra

ASSET

CLEP

COMPASS

NC DAP

PERT

THEA

TSI

VPT

U.S. Military

ASVAB

Educators

ABCTE American Board

AECTP

AEPA

STAAR

TAKS

Virginia SOL Algebra 1

Virginia SOL Geometry

Washington Algebra 1

Washington Geometry

Math Test Prep

DTU Delhi MTech Entrance Exam

IIIT Delhi MTech Entrance

BITS Mesra ME M.Tech Entrance Exam

Himachal Pradesh Polytechnic Admission Test

Uttarakhand State Entrance Examination (UKSEE)

Telangana PGECET

School of Planning and Architecture, Bhopal PG & doctoral admissions

IIIT Vadodara M.Tech and Phd

IIM entrance exam

Uganda Advanced Certificate of Education

General Educational Development (GED)

Advanced Placement Program

SAT

PSAT

ACT

PLAN

California High School Exit Exam

Connecticut Academic Performance Test

Connecticut Mastery Test

Florida Comprehensive Assessment Test ( FCAT ) Commonwealth

Accountability Testing System ( CATS )

High School Proficiency Assessment

Indiana Statewide Testing for Educational Progress ( ISTEP )

Regents Examinations

Michigan Merit Exam

Massachusetts Comprehensive Assessment System

Texas Assessment of Knowledge and Skills (TAKS)

Tennessee Comprehensive Assessment Program (TCAP)

Ohio Graduation Test

Pennsylvania System of School Assessment

Standards of Learning

Washington Assessment of Student Learning

Georgia High School Graduation Test

Colorado Student Assessment Program (CSAPs)

HSPT – High School Placement Test

SHSAT High Schools Admissions Test

ISEE – Independent School Entrance Examination

SSAT – Secondary School Admission Test

TACHS

HKCEE – Hong Kong Certificate of Education Examination

HKALE – Hong Kong Advanced Level Examination

PSLE Singapore

OKS Turkey

UPSR Malaysia

CITO Toets

Common Entrance Examination

Eleven-plus

GCE A-level – England, Wales and Northern Ireland

Access to HE Diploma

Scottish Higher/Advanced Higher

Cambridge Pre-U Diploma

Matura

Higher School Certificate – New South Wales External Assessment

Victorian Certificate of Education/Victorian Certificate of Applied

Learning

Queensland Certificate of Education

South Australian Certificate of Education

Western Australian Certificate of Education

Tasmanian Certificate of Education

Australian Capital Territory Year 12 Certificate

Northern Territory Certificate of Education

maths tricks

maths tricks for fast calculation

maths shortcuts for competitive exams

maths tricks for fast calculation

maths magic tricks

maths puzzles

maths teacher

maths

maths addition

maths antics

maths aptitude

maths algebra

maths addition for kids

maths aptitude shortcuts

maths activity for class 8

maths age problems

maths addition and subtraction for kids

maths app

a maths teacher

a maths o level

a maths puzzle euler trail and solution

a maths 360

a maths trick

a* maths gcse

a level maths

a level maths core 1

a level maths mechanics 1

maths blog

maths book

maths basics

maths baseline paper

maths b

b tech maths

igcse maths b

maths class

maths class 12

maths class 11

maths class 10

maths class 9

maths class 8

maths calculation tricks

maths class 11 sequence and series

maths class 11 straight line

les maths c'est nul

maths division

maths easy tricks

maths for kids

maths for ssc

maths for competitive exams

maths for ssc cgl

maths for bank po

maths for gate

maths for class 1

maths for class 4

maths guru

maths genius

maths gate

maths gate lectures

maths hsc

profit and loss basics,

profit and loss definition,

formula of profit and loss,

purpose of profit and loss account,

statement of profit and loss format,

profit and loss problems,

Profit and loss,

How can calculate profit and loss?,

profit and loss basics concepts,

percentage profit and loss basics,

maths aptitude shortcuts,

maths activity for class 8,

cbse ncert cisce nios ICSE wbsc WBBSE IB bse igcse icsce aisse hslc aicte mpbse isc sslc jkbose jksbse cce hbse matric GSHSEB isc state board scert nenbse seba cgbse samacheer

online school videos and lectures

Higher secondary school

Andhra Pradesh Secondary Intermediate

Bihar School Intermediate

Meghalaya Mizoram Nagaland Odisha Assam Kerala Madhya Pradesh

Maharashtra Manipur Higher Secondary

Council for the Indian School Certificate Examinations

the Central Board for Secondary Education

the National Institute of Open Schooling

Pre-primary

Primary

Middle/ upper-primary

Senior secondary

inter college

Board of Secondary Education maths

CBSE Maths

JEE MAIN Exam

JEE Advanced Exam (IIT-JEE )

Kerala KEAM

VITEEE

BITSAT Entrance Exam

Manipal University Online Entrance Test

Amrita Engineering Entrance Examination AEEE

SRMJEEE - SRM Engineering Entrance Examination

Telangana EAMT

AccuPlacer

ACT

ALEKS College Algebra

ASSET

CLEP

COMPASS

NC DAP

PERT

THEA

TSI

VPT

U.S. Military

ASVAB

Educators

ABCTE American Board

AECTP

AEPA

STAAR

TAKS

Virginia SOL Algebra 1

Virginia SOL Geometry

Washington Algebra 1

Washington Geometry

Math Test Prep

DTU Delhi MTech Entrance Exam

IIIT Delhi MTech Entrance

BITS Mesra ME M.Tech Entrance Exam

Himachal Pradesh Polytechnic Admission Test

Uttarakhand State Entrance Examination (UKSEE)

Telangana PGECET

School of Planning and Architecture, Bhopal PG & doctoral admissions

IIIT Vadodara M.Tech and Phd

IIM entrance exam

Uganda Advanced Certificate of Education

General Educational Development (GED)

Advanced Placement Program

SAT

PSAT

ACT

PLAN

California High School Exit Exam

Connecticut Academic Performance Test

Connecticut Mastery Test

Florida Comprehensive Assessment Test ( FCAT ) Commonwealth

Accountability Testing System ( CATS )

High School Proficiency Assessment

Indiana Statewide Testing for Educational Progress ( ISTEP )

Regents Examinations

Michigan Merit Exam

Massachusetts Comprehensive Assessment System

Texas Assessment of Knowledge and Skills (TAKS)

Tennessee Comprehensive Assessment Program (TCAP)

Ohio Graduation Test

Pennsylvania System of School Assessment

Standards of Learning

Washington Assessment of Student Learning

Georgia High School Graduation Test

Colorado Student Assessment Program (CSAPs)

HSPT – High School Placement Test

SHSAT High Schools Admissions Test

ISEE – Independent School Entrance Examination

SSAT – Secondary School Admission Test

TACHS

HKCEE – Hong Kong Certificate of Education Examination

HKALE – Hong Kong Advanced Level Examination

PSLE Singapore

OKS Turkey

UPSR Malaysia

CITO Toets

Common Entrance Examination

Eleven-plus

GCE A-level – England, Wales and Northern Ireland

Access to HE Diploma

Scottish Higher/Advanced Higher

Cambridge Pre-U Diploma

Matura

Higher School Certificate – New South Wales External Assessment

Victorian Certificate of Education/Victorian Certificate of Applied

Learning

Queensland Certificate of Education

South Australian Certificate of Education

Western Australian Certificate of Education

Tasmanian Certificate of Education

Australian Capital Territory Year 12 Certificate

Northern Territory Certificate of Education

maths tricks

maths tricks for fast calculation

maths shortcuts for competitive exams

maths tricks for fast calculation

maths magic tricks

maths puzzles

maths teacher

maths

maths addition

maths antics

maths aptitude

maths algebra

maths addition for kids

maths aptitude shortcuts

maths activity for class 8

maths age problems

maths addition and subtraction for kids

maths app

a maths teacher

a maths o level

a maths puzzle euler trail and solution

a maths 360

a maths trick

a* maths gcse

a level maths

a level maths core 1

a level maths mechanics 1

maths blog

maths book

maths basics

maths baseline paper

maths b

b tech maths

igcse maths b

maths class

maths class 12

maths class 11

maths class 10

maths class 9

maths class 8

maths calculation tricks

maths class 11 sequence and series

maths class 11 straight line

les maths c'est nul

maths division

maths easy tricks

maths for kids

maths for ssc

maths for competitive exams

maths for ssc cgl

maths for bank po

maths for gate

maths for class 1

maths for class 4

maths guru

maths genius

maths gate

maths gate lectures

maths hsc

Комментарии

0:09:10

0:09:10

3:19:01

3:19:01

0:04:31

0:04:31

0:00:36

0:00:36

0:19:10

0:19:10

0:44:23

0:44:23

1:26:27

1:26:27

2:51:50

2:51:50

1:00:36

1:00:36

0:00:16

0:00:16

0:00:55

0:00:55

0:23:00

0:23:00

0:00:29

0:00:29

0:29:58

0:29:58

0:00:20

0:00:20

0:00:52

0:00:52

0:00:56

0:00:56

0:52:06

0:52:06

0:01:00

0:01:00

0:00:20

0:00:20

0:20:53

0:20:53

0:54:02

0:54:02

0:00:18

0:00:18

0:14:26

0:14:26