filmov

tv

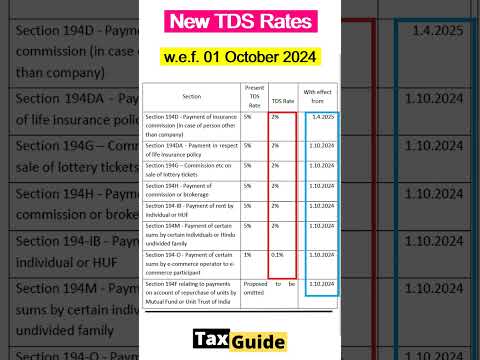

New TDS Rates on Rent: Income Tax: New Changes from 01 October 24

Показать описание

New TDS and TCS rates changes are annouced in Budget 2024 and notified through the Finance act (No.2) 2024 are going to effective from 1st October 2024.

To Buy Google Drive / Pen Drive contact at :

@ Delhi : 011-45695551

@ Gorakhpur : +91-7052208065

@ Mobile : +91-9889004575

To Buy Google Drive / Pen Drive contact at :

@ Delhi : 011-45695551

@ Gorakhpur : +91-7052208065

@ Mobile : +91-9889004575

New TDS Rate on Rent u/s 194I & 194IB from 1 October 2024 | TDS on Rent | New TDS Rates

Rent Income TDS rate reduced from 1 October 2024 | TDS on Rent | 194IB | How to pay TDS on Rent

TDS Section and Rates | TDS Rate Chart for FY 2024-25 | TDS Slab 24-25 | TDS Rate on Salary FD Rent

New TDS Rates on Rent: Income Tax: New Changes from 01 October 24

Rent Income TDS rate reduced from 1 October 2024 | TDS on Rent | 194IB | How to pay TDS on Rent

Rent Income TDS rate reduced from 1 October 2024 | TDS on Rent | 194IB | How to pay TDS on Rent

TDS on RENT. Rate reduced from 1 October 2024 | TDS on Rent | 194IB | How to pay TDS on Rent

New TDS Rate Chart from 1 October 2024, NEW TDS/TCS Rates F.Y. 2024-25,TDS changes from 1 October 24

Deduction of Home Loan Interest in New Tax Regime | Home Loan Interest in New Tax Regime Income Tax

TDS rate reduced from 1 October 2024 | TDS on Rent | 194IB | How to pay TDS on Rent | Complete Guide

REVISED TDS RATE 01-10-24 | NEW TDS RATE EFFECTIVE FROM 01-10-24 | NEW TDS RATE CHART F.Y. 24-25

New TDS rates changes from 1 October 2024 #shorts_video

TDS Rate chart fy 2024-25 | TDS Rate chart ay 2025-26 | TDS Rate | TDS limit | TDS Chart 2024-25

2%TDS on Rent from 1 October 2024| TDS u/s 194IB | TDS on Rent #shorts

TDS rates changes from 01 October 2024 | New TDS rates from 01-10-2024 | TDS rate changed #shorts

Rent Income TDS rate reduced from 1 October 2024 | TDS on Rent | 194IB | How to pay TDS on Rent

TDS on Rent - 194I and 194IB || CA Tarique Khichi

Income tax news: New TDS rates effective October 1 #incometax #tax

New TDS Rate on Rent u/s 194I & 194IB / 1st Oct 2024 / 2% , 5% or 10% | New TDS Rates / Tax G

Changes in TDS Rates from 1st Oct 2024 | New TDS Rates from 1 st Oct -2024 |TDS Rate on commission

New TDS Rate on Rent from 1st October 2024 - Section 194IB of Income Tax Act | TDS on Rent Income

Changes in TDS Rate by Finance Act 2024 | TDS on rent , TDS on commission , TDS on e commerce

TDS Rate on Rent reduced from 1 October 2024 | TDS on Rent u/s 194-IB | Form 26QC for TDS on Rent

TDS Rate changed in Budget 2024 | New TDS Rates from 1 Oct 2024

Комментарии

0:09:43

0:09:43

0:08:08

0:08:08

0:05:45

0:05:45

0:07:43

0:07:43

0:01:01

0:01:01

0:13:05

0:13:05

0:00:28

0:00:28

0:14:38

0:14:38

0:04:19

0:04:19

0:09:39

0:09:39

0:06:23

0:06:23

0:00:11

0:00:11

0:10:01

0:10:01

0:01:01

0:01:01

0:00:36

0:00:36

0:02:16

0:02:16

0:00:46

0:00:46

0:01:00

0:01:00

0:09:37

0:09:37

0:06:31

0:06:31

0:12:15

0:12:15

0:05:33

0:05:33

0:04:18

0:04:18

0:12:14

0:12:14