filmov

tv

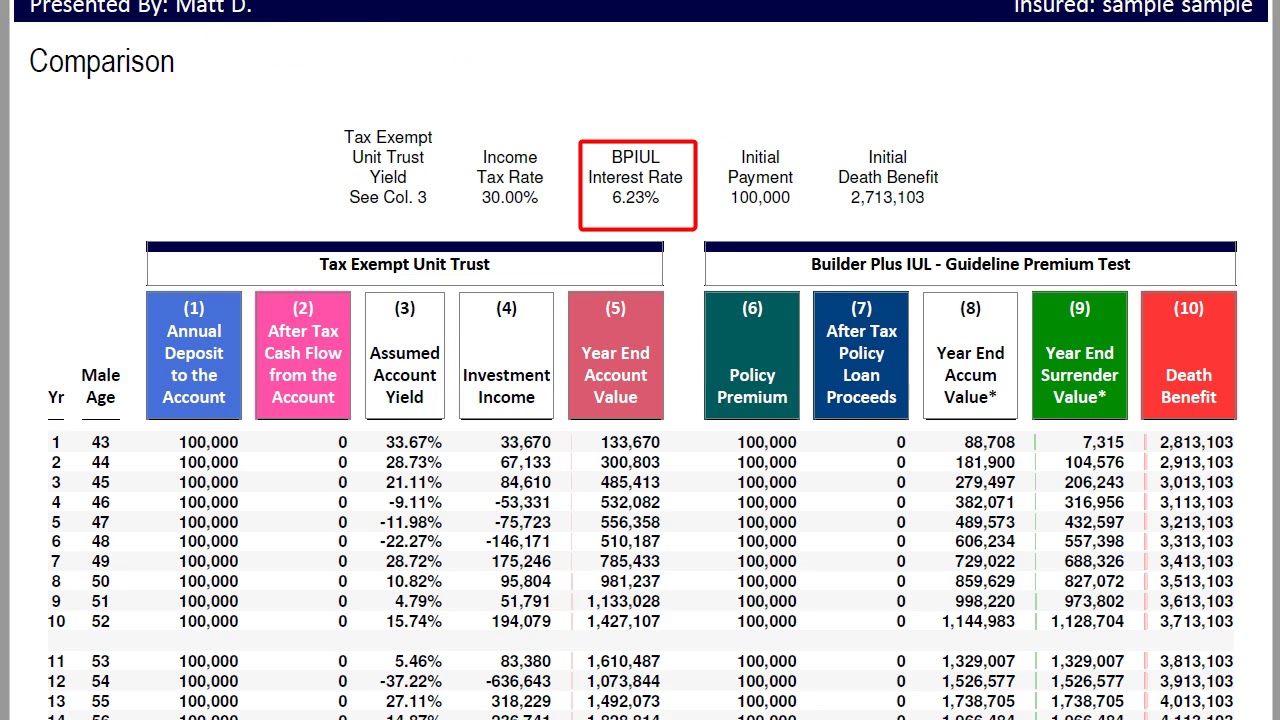

Indexed Universal life vs Roth IRA - IUL vs S&P returns with no fees

Показать описание

Everyone including me loves the ROTH IRA. For good reason! How does an IUL compare to a Roth IRA (IUL VS ROTH IRA) fully linked to the S&P including dividends and absolutely no fees? You gotta see it to believe it.

Indexed Universal Life insurance can be a powerful piece of your overall financial strategy if its properly implemented. Most financial advisers are terrible (are you surprised?) and design policies to maximize commissions. This isn't that. Check out how IUL compares to no load no fee S&P returns inside a fully tax exempt ROTH IRA.

If you are interested in exploring an indexed Universal Life policy check out the link below and take the quiz:

Have other questions?

Book a Time to chat here:

OR

Send us your question here:

Indexed Universal Life is not for everyone! It is best suited for high earners looking for additional places to put away money. Or for those who are unwilling to take risk in the stock market.

IUL policies can generate significant tax free retirement income without any market risk as long as they are properly structured. Too many agents don't know how indexed universal life works and sell policies designed for maximum commission instead of maximum tax free retirement income.

Some think "properly structured" is just a scare tactic to say I do it right but others do it wrong. Check out some previous videos I've done on IUL and how bad it can get in the wrong hands.

Комментарии

0:06:33

0:06:33

0:05:05

0:05:05

0:20:05

0:20:05

0:17:10

0:17:10

0:04:49

0:04:49

0:05:09

0:05:09

0:00:31

0:00:31

0:20:54

0:20:54

0:33:53

0:33:53

0:02:52

0:02:52

0:01:00

0:01:00

0:02:00

0:02:00

0:12:28

0:12:28

0:16:38

0:16:38

0:39:03

0:39:03

0:14:16

0:14:16

0:17:10

0:17:10

0:07:27

0:07:27

0:10:51

0:10:51

0:09:19

0:09:19

0:11:27

0:11:27

0:08:10

0:08:10

0:04:34

0:04:34

0:10:25

0:10:25