filmov

tv

IFRS: Financial Instruments I IFRS 9 I Financial Assets and Liabilities I uae ct

Показать описание

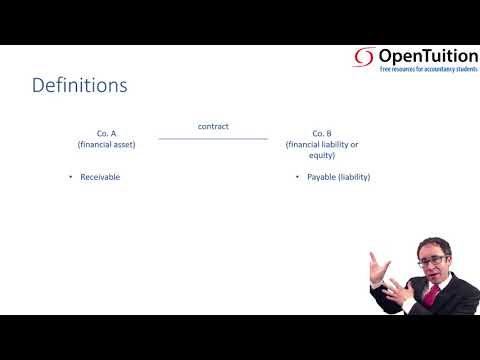

Explore the fundamentals of IFRS 9 Financial Instruments in this in-depth video. Learn how financial assets and liabilities are recognized, classified, and measured under the International Financial Reporting Standards. This video breaks down complex accounting principles into simple, practical examples to help accountants, auditors, and finance professionals understand the key aspects of IFRS 9.

Key Topics Covered:

Overview of IFRS 9 Financial Instruments

Classification of financial assets and liabilities

Measurement principles: Amortized cost, FVOCI, and FVTPL

Impairment of financial assets and the Expected Credit Loss (ECL) model

Practical examples for financial reporting

IFRS 9 is an International Financial Reporting Standard that addresses the accounting for financial instruments. It establishes principles for the classification and measurement of financial assets and liabilities, impairment of financial assets, and hedge accounting. Under IFRS 9, financial assets are categorized based on the entity's business model and the contractual cash flow characteristics. The standard introduces an expected credit loss model for impairment, requiring entities to recognize potential losses earlier than under previous standards. Additionally, IFRS 9 enhances the reporting of hedge risk, providing more transparency and alignment with risk management practices. It aims to improve consistency and comparability in financial reporting.

🟨 Connect with Me 🟨

#IFRS9 #FinancialInstruments #AccountingStandards #FinancialAssets #FinancialLiabilities #IFRSExplained #FinanceEducation #AccountingTutorials #InternationalAccounting

Key Topics Covered:

Overview of IFRS 9 Financial Instruments

Classification of financial assets and liabilities

Measurement principles: Amortized cost, FVOCI, and FVTPL

Impairment of financial assets and the Expected Credit Loss (ECL) model

Practical examples for financial reporting

IFRS 9 is an International Financial Reporting Standard that addresses the accounting for financial instruments. It establishes principles for the classification and measurement of financial assets and liabilities, impairment of financial assets, and hedge accounting. Under IFRS 9, financial assets are categorized based on the entity's business model and the contractual cash flow characteristics. The standard introduces an expected credit loss model for impairment, requiring entities to recognize potential losses earlier than under previous standards. Additionally, IFRS 9 enhances the reporting of hedge risk, providing more transparency and alignment with risk management practices. It aims to improve consistency and comparability in financial reporting.

🟨 Connect with Me 🟨

#IFRS9 #FinancialInstruments #AccountingStandards #FinancialAssets #FinancialLiabilities #IFRSExplained #FinanceEducation #AccountingTutorials #InternationalAccounting

0:21:29

0:21:29

0:36:48

0:36:48

0:13:08

0:13:08

0:12:40

0:12:40

0:12:22

0:12:22

4:03:33

4:03:33

0:03:16

0:03:16

0:03:21

0:03:21

0:25:30

0:25:30

0:06:20

0:06:20

0:41:55

0:41:55

0:43:19

0:43:19

0:04:22

0:04:22

3:08:02

3:08:02

0:22:33

0:22:33

0:20:51

0:20:51

0:14:06

0:14:06

0:06:26

0:06:26

0:33:16

0:33:16

1:04:36

1:04:36

0:11:05

0:11:05

1:58:50

1:58:50

0:03:10

0:03:10

0:32:52

0:32:52