filmov

tv

The financial product for a better retirement!

Показать описание

Today we discuss the suitability of annuities in pre-retirement and post-retirement portfolios. Specifically, we will talk about the Single Premium Immediate Annuity or, "SPIA."

Please subscribe and "like." All comments are welcome.

Please subscribe and "like." All comments are welcome.

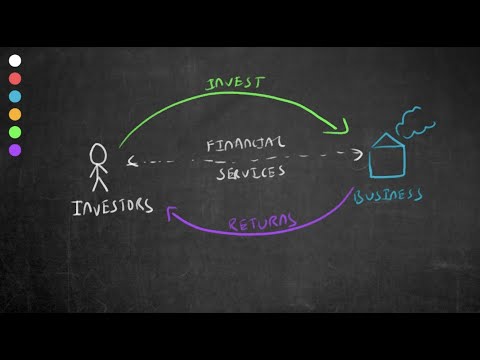

Introduction to Financial Services

The Basics of Investing (Stocks, Bonds, Mutual Funds, and Types of Interest)

What is the Financial Services Sector?

Financial Services 101: An Introduction to the Financial Industry

10 Simple Financial Products Worth Every Penny

A New Financial Product: What to Measure and How

The Future of Financial Services - Tech in 2030

World Bank Treasury Financial Products and Services

Is Energy Going to do Well in the Long-Term? #energy #sp500

How to Start a Financial Services Business: Find Your Purpose

How AI Is Powering the Future of Financial Services | JPMorgan Chase & Co.

Top 10 Types of Financial Services Available | #wealth

Types of financial product ( lecture 5) sybms.

Financial services marketing

Learn about financial products from Keenan Honkai Star Rail

How financial services are benefiting from AI

How Digital Financial Services Can Help the World's Poor

Sagt das dein Finanzberater? 🫨

Introduction to Financial Services

So investiert Andreas Beck sein Geld! 💵

Insurance and the financial services industry

Innovation in Consumer Financial Products | What We Do | J.P. Morgan

Types of Financial Products

HDB Financial Services Rejects $2Bn From Japan's MUFG

Комментарии

0:02:38

0:02:38

0:07:26

0:07:26

0:07:34

0:07:34

0:02:29

0:02:29

0:14:51

0:14:51

0:01:20

0:01:20

0:01:47

0:01:47

0:02:26

0:02:26

0:00:37

0:00:37

0:03:42

0:03:42

0:19:41

0:19:41

0:02:51

0:02:51

0:04:07

0:04:07

0:16:34

0:16:34

0:00:53

0:00:53

0:06:02

0:06:02

0:04:28

0:04:28

0:00:49

0:00:49

0:08:02

0:08:02

0:00:43

0:00:43

0:01:23

0:01:23

0:01:07

0:01:07

0:02:43

0:02:43

0:02:40

0:02:40