filmov

tv

I Was Wrong About Real Estate

Показать описание

#Masterworks - The only investment platform dedicated to art investing

Invest in blue-chip art for the very first time. Purchase shares in great masterpieces from artists like Picasso, Warhol, and more!

*Since its inception, Masterworks has only sold three paintings, each realizing a net annual return of over 30%. This is not an indication of Masterworks’ overall performance. Past performance does not guarantee future results. Masterworks, in its sole discretion, may hold paintings before selling for up to 10 years.

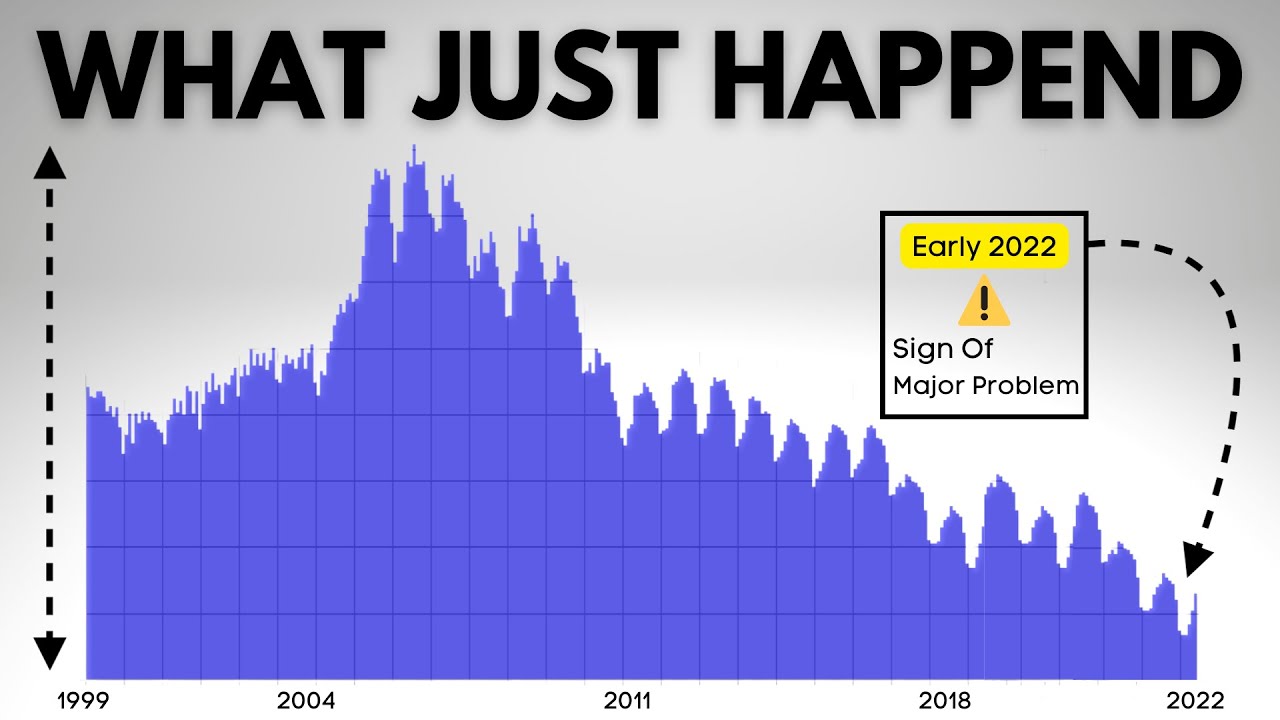

The housing market, one big house of cards, that according to most experts is already in the middle of a collapse. Look anywhere from CNBC to YouTube, to Jerome Powell, and the trend is clear. The housing market is set to implode. On paper it makes sense. A large number of variables are flashing red. Mortgage rates have risen to nearly 6%, and home prices are hitting new highs daily. The average payment has went up over 70% YoY, and plenty of companies involved in real estate are warning of a slowing market, some even laying off large percentages of their workforce.

Link to Bill McBride Blog/Substack

RedFin Data

Link to my Twitter

0:00 - 0:57 Intro

2:17 - 3:48 Signs of A Crash

3:49 - 4:33 Leading Indicators

4:44 - 7:40 Why I Could Be Right

7:41 - 8:28 Position Update & Outro

Invest in blue-chip art for the very first time. Purchase shares in great masterpieces from artists like Picasso, Warhol, and more!

*Since its inception, Masterworks has only sold three paintings, each realizing a net annual return of over 30%. This is not an indication of Masterworks’ overall performance. Past performance does not guarantee future results. Masterworks, in its sole discretion, may hold paintings before selling for up to 10 years.

The housing market, one big house of cards, that according to most experts is already in the middle of a collapse. Look anywhere from CNBC to YouTube, to Jerome Powell, and the trend is clear. The housing market is set to implode. On paper it makes sense. A large number of variables are flashing red. Mortgage rates have risen to nearly 6%, and home prices are hitting new highs daily. The average payment has went up over 70% YoY, and plenty of companies involved in real estate are warning of a slowing market, some even laying off large percentages of their workforce.

Link to Bill McBride Blog/Substack

RedFin Data

Link to my Twitter

0:00 - 0:57 Intro

2:17 - 3:48 Signs of A Crash

3:49 - 4:33 Leading Indicators

4:44 - 7:40 Why I Could Be Right

7:41 - 8:28 Position Update & Outro

Комментарии

0:00:40

0:00:40

0:00:42

0:00:42

1:04:10

1:04:10

0:02:19

0:02:19

0:12:00

0:12:00

0:00:10

0:00:10

0:09:15

0:09:15

0:09:00

0:09:00

0:00:44

0:00:44

0:08:58

0:08:58

0:09:46

0:09:46

0:00:24

0:00:24

0:00:08

0:00:08

0:10:38

0:10:38

0:00:37

0:00:37

0:00:06

0:00:06

0:00:07

0:00:07

0:01:24

0:01:24

0:04:03

0:04:03

0:00:17

0:00:17

0:00:15

0:00:15

0:00:23

0:00:23

0:00:14

0:00:14

0:00:22

0:00:22