filmov

tv

PRICE ACTION TRADING: HOW TO TRADE THE OPEN ✅

Показать описание

🔴 Trading is Risky! 74 to 89% of retail investors lose money!

✅ Please like, subscribe & comment if you enjoyed - it helps a lot!

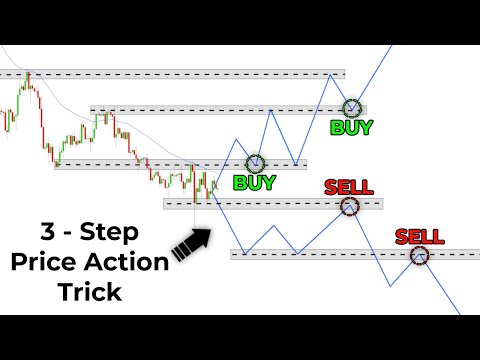

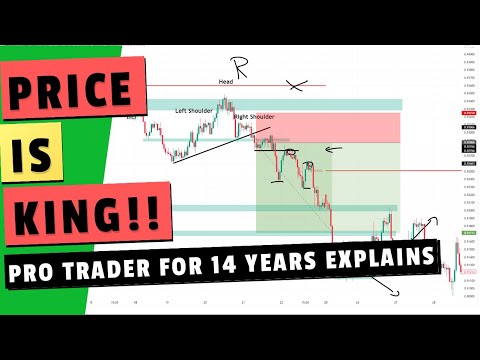

Different Open Types. The Open can be a lucrative time to trade but it can also be an absolute death trap. What we don't want to do is to chase the open... What are the different Open types? OK.

So if you have the discipline challenge or you're inexperienced the open will just exaggerate your weak points. There is nothing wrong with waiting until things have stabilised.

You don't need to trade the open but for those looking to improve their trading during these times - this video is for you.

Open Drive - start off and rip in one direction. Assuming you've identified momentum you need to find a point where you can express that continuation of momentum with a structured trade. At the end of the day this is a good test of your discipline.

Open Test Drive the speed of the move back in the direction of the trend

Open Auction - I tend to avoid these

Open Rejection Reverse

✅ Our channel sponsor for this month are Trade Nation meaning these guys are covering our costs of operation. We only accept reputable and properly regulated providers as sponsors. Please support us by trading with this provider. Trade Nation offer the popular MT4 platform as well as an easy-to-use web trading platform with fixed spreads.

📜 Disclaimer 📜

81.7% of retail investors lose money when trading CFDs and spread betting with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

Related Videos

More Videos on Price Action Trading (Playlist)

✅ Please like, subscribe & comment if you enjoyed - it helps a lot!

Different Open Types. The Open can be a lucrative time to trade but it can also be an absolute death trap. What we don't want to do is to chase the open... What are the different Open types? OK.

So if you have the discipline challenge or you're inexperienced the open will just exaggerate your weak points. There is nothing wrong with waiting until things have stabilised.

You don't need to trade the open but for those looking to improve their trading during these times - this video is for you.

Open Drive - start off and rip in one direction. Assuming you've identified momentum you need to find a point where you can express that continuation of momentum with a structured trade. At the end of the day this is a good test of your discipline.

Open Test Drive the speed of the move back in the direction of the trend

Open Auction - I tend to avoid these

Open Rejection Reverse

✅ Our channel sponsor for this month are Trade Nation meaning these guys are covering our costs of operation. We only accept reputable and properly regulated providers as sponsors. Please support us by trading with this provider. Trade Nation offer the popular MT4 platform as well as an easy-to-use web trading platform with fixed spreads.

📜 Disclaimer 📜

81.7% of retail investors lose money when trading CFDs and spread betting with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

Related Videos

More Videos on Price Action Trading (Playlist)

Комментарии

0:08:11

0:08:11

0:47:17

0:47:17

0:05:10

0:05:10

0:08:54

0:08:54

0:14:29

0:14:29

0:29:34

0:29:34

0:49:19

0:49:19

0:01:00

0:01:00

0:11:27

0:11:27

0:00:59

0:00:59

0:10:33

0:10:33

0:11:56

0:11:56

0:09:46

0:09:46

0:49:26

0:49:26

0:00:54

0:00:54

0:23:08

0:23:08

0:00:20

0:00:20

0:32:40

0:32:40

0:01:00

0:01:00

0:24:22

0:24:22

0:16:47

0:16:47

0:19:18

0:19:18

0:05:57

0:05:57

0:57:18

0:57:18