filmov

tv

$100,000 No longer Buys A Middle Class Lifestyle

Показать описание

Why $100,000 May No Longer Buy A Middle Class Lifestyle:

00:00 Intro

01:13 Median Income

03:16 Child Care

04:14 Housing

05:57 Transportation

07:11 Savings & Investments

08:08 Income Needed For Middle Class

10:03 Family Dynamics

Disclaimer: Please note that this video is made for entertainment purposes only and not to be taken as financial advice. Always make sure to do your own research.

Thanks for watching, I appreciate you!

If You Make Less Than $100K/Year, You’re Ignoring the #1 Wealth Hack (It’s Easier Than You Think)...

What Just Over £1,000,000 Buys You In Beautiful Southern Italy 🇮🇹

DETALHANDO o processo que VENDE R$858 MILHÕES por ano

PRINTING MONEY 😳💷✨ | Jeremy Lynch #Shorts

$0.01 vs 1 Million 😮 😮

World's Most Expensive Water Bottle

The Richest Players in Blox Fruits..

Why You Should Invest Early

I FOUND 'INFINITE VBUCKS'

Forza Accidentally Gave Me 1,000,000 WHEELSPINS?!

$10 Every Week into S&P 500 ETF VOO (AMAZING)

The FASTEST Money Method in GTA Online (Stash Houses)

The Rock Vs MrBeast For $100,000

How To Make Money Fast

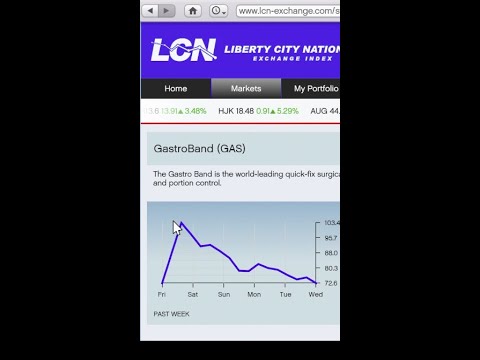

How to Make $20 Million in 1 Minute! GTA 5 Story Mode #shorts

3 Side Hustle Ideas To Make $500/Day 🤑

I Trained With The US ARMY For 100 Hours!

When Your Girlfriend Does Not Finish Her FOOD #shorts

HOW TO GET 200,000 IN GTA 5 ONLINE IN LESS THEN 2 MINUTES #shorts

NBA players have the biggest hands on the planet 😂 (via @arm1ne_7)

How to get a FREE iPhone every year #shorts

He Owns 1 Million Cigarettes #131

Strict Stop Loses Lose You Money...

If I Give Away $10,000 The Video Ends

Комментарии

1:06:35

1:06:35

0:16:38

0:16:38

0:33:54

0:33:54

0:00:26

0:00:26

0:00:44

0:00:44

0:00:29

0:00:29

0:00:26

0:00:26

0:00:48

0:00:48

0:00:11

0:00:11

0:00:22

0:00:22

0:00:16

0:00:16

0:00:28

0:00:28

0:00:55

0:00:55

0:00:35

0:00:35

0:00:39

0:00:39

0:00:50

0:00:50

0:00:27

0:00:27

0:00:33

0:00:33

0:00:17

0:00:17

0:00:22

0:00:22

0:00:22

0:00:22

0:01:00

0:01:00

0:00:59

0:00:59

0:00:39

0:00:39