filmov

tv

Evaluating Chris Kirkpatrick's '6 Lies to Sell IUL' Video

Показать описание

I've had many disagreements with Chris Kirkpatrick over the years until recently. Chris released a video where he covers 6 lies people say to sell IUL. Let's look at all 6 of his points and add to it.

🔹 Connect With Us 🔹

#taxfreeretirement

🔹 Connect With Us 🔹

#taxfreeretirement

Did DC Insider Get the UFO & Nukes Story Totally Wrong?

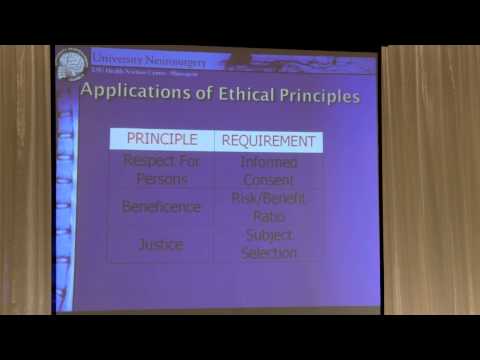

Evaluating Therapeutic Trials

Sntm Cycle 2: Official Opening

WS2 ASGBI Centenary Free Paper Series

I read the top 100 scientific papers of all time

The Truth about Saturated Fat | New Narrative Review

Avi Loeb's Paper made 'Pentagon Says Alien MotherShip' in News Headers

Razvan Pascanu - Continual learning for deep learning and deep reinforcement learning

Mueller Probe's Many Threads Are Why Details Can't Be Public | Rachel Maddow | MSNBC

Bank Regulator Nominee Grilled By Senate; Financial Firms Profit From Shipping Clog | NTD Business

ASM 2016: Beyond ICU Walls - Friday Session 1.30pm - 3.30pm

Kent Hovind vs Dinosaurs [PART 4]

Providing Effective Behavioral Parent Training: Research and Practice Recommendations

The Demon in Democracy: Totalitarian Temptations in Free Societies with Ryszard Legutko

Julio Jones Trade Reaction | From A Saints Fan | Falcons trade Julio Jones to Titans

Комментарии

2:14:35

2:14:35

0:24:10

0:24:10

0:00:59

0:00:59

1:11:34

1:11:34

0:15:44

0:15:44

0:43:11

0:43:11

0:30:03

0:30:03

0:54:06

0:54:06

0:21:47

0:21:47

0:28:48

0:28:48

2:02:47

2:02:47

0:21:56

0:21:56

0:59:15

0:59:15

1:24:02

1:24:02

0:03:25

0:03:25