filmov

tv

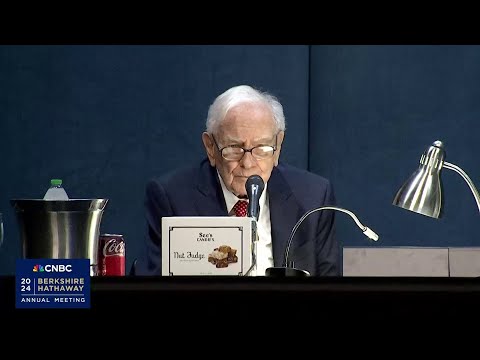

The Truth about Warren Buffett?

Показать описание

Chamath Palihapitiya recently stated that Jeff Bezos is the best investor of our generation, better than Warren Buffett.

The Oracle of Omaha has a reputation as the gentle GOAT of investing, but is there more to this than meets the eye?

The story begins in 1942, when Warren Buffet bought his first shares at the age of just 11.

This is same year that his father Howard Buffett ran for the U.S. House of Representatives in the Nebraska district.

He won, and became a member of Congress in 1943.

Before this, Howard worked at a small stock brokerage firm.

He was reelected twice. However, in 1952, he decided against seeking another term and returned to his investment business in Omaha, Buffett-Falk & Co., where he worked until shortly before his death in 1964.

But what about Warren Buffett?

In 1951, after graduating from Columbia, where he was taught by Benjamin Graham, Buffett worked for three years at his father's firm as an investment salesman.

In 1954, Buffett accepted a job at Benjamin Graham's partnership, working as a securities analyst.

His starting salary was $12,000 a year - the equivalent of $114,000 today.

However, just two years later, Graham retired and Buffett started his own investment partnership.

He went to his father's acquaintances to raise Capital for his first fund.

These were prominent families in Nebraska with big businesses and political connections.

For example, across the street was the family whose son became the CEO of Coca Cola - that family gave him $10,000.

In 2012, the STOCK Act or The Stop Trading on Congressional Knowledge Act was signed into law.

The law prohibits the use of non-public information for private profit, including insider trading by members of Congress and other government employees.

Remember, Buffett's father used to be in Congress.

The only people who were, before 2012, allowed to trade on insider information without having criminal charges brought against them were congressmen.

Remember, Buffett's father was a stock market broker prior to being elected and going to Congress, hence he had a comprehensive knowledge of the stock market and clearly had an interest in it.

Imagine you are Warren Buffett, and you can:

1). Get insider information to trade on it

2). Get a six-figure position after College.

3). After a few years, set up your own fund, getting money from wealthy family friends

4). Pay no dividends to investors and only put a hundred bucks of your own money into the fund

5). Let the mathematics of compounding work its magic as you bring in more institutional money

6). Become so connected Politically and connected on Wall Street that you can get special deals, which have practically no risk as you know bailouts are coming. For example, in the 2008 crisis, Berkshire owned stock valued at more than $13 billion in the top recipients of the TARP funds, and Berkshire had at least twice as much dependence on bailed-out banks as any other large investor.

7). Have billions of dollars on hand, remember you ain't paying any dividends to investors, ready for the inevitable economic recession to hit so that you can sweep up cheap assets.

8). Be holier-than-thou (i.e. calling derivatives "financial weapons of mass destruction" when, during the height of the 2008 crisis, Berkshire sold more than $2.5 billion worth of credit default swaps; OR what about Buffett's reputation as the saviour in the Great Recession when Berkshire is the majority owner of Moody's, who played a key role in inflating the crisis in 2008 - via their questionable debt and derivative ratings which inflated the mortgage and subprime market.

What about Buffett's status as the GOAT of Investing?

Billionaire Chamath Palihapitiya has even stated that Jeff Bezos is the best investor of our generation, not Warren Buffett.

Buffett has missed out on an entire raft of tech and Berkshire has underperformed the S&P 500 in recent years.

Also, he has been critical of Bitcoin, describing it as "rat poison squared"

Ultimately, Buffett is worth $73 billion, he doesn't need to have an in-depth understanding of new age tech.

Also, Buffett has a huge stake in Finance 1.0, why would he give props to Finance 2.0?

It's worth noting that Howard Buffett strongly supported the gold standard because he believed it would limit the ability of government to inflate the money supply and spend beyond its means.

His son Warren, however, hates gold. See the Cantillon Effect as to why:

Some have even argued that Buffett's success can be summarised by the following:

First Deals = Insider Information

Last Deals = Cantillon Effect

What are your thoughts?

Is it true... or false?

PATREON TO TIP OR ACCESS EXCLUSIVE CONTENT:

DISCLAIMER: NOT INVESTMENT ADVICE

The Oracle of Omaha has a reputation as the gentle GOAT of investing, but is there more to this than meets the eye?

The story begins in 1942, when Warren Buffet bought his first shares at the age of just 11.

This is same year that his father Howard Buffett ran for the U.S. House of Representatives in the Nebraska district.

He won, and became a member of Congress in 1943.

Before this, Howard worked at a small stock brokerage firm.

He was reelected twice. However, in 1952, he decided against seeking another term and returned to his investment business in Omaha, Buffett-Falk & Co., where he worked until shortly before his death in 1964.

But what about Warren Buffett?

In 1951, after graduating from Columbia, where he was taught by Benjamin Graham, Buffett worked for three years at his father's firm as an investment salesman.

In 1954, Buffett accepted a job at Benjamin Graham's partnership, working as a securities analyst.

His starting salary was $12,000 a year - the equivalent of $114,000 today.

However, just two years later, Graham retired and Buffett started his own investment partnership.

He went to his father's acquaintances to raise Capital for his first fund.

These were prominent families in Nebraska with big businesses and political connections.

For example, across the street was the family whose son became the CEO of Coca Cola - that family gave him $10,000.

In 2012, the STOCK Act or The Stop Trading on Congressional Knowledge Act was signed into law.

The law prohibits the use of non-public information for private profit, including insider trading by members of Congress and other government employees.

Remember, Buffett's father used to be in Congress.

The only people who were, before 2012, allowed to trade on insider information without having criminal charges brought against them were congressmen.

Remember, Buffett's father was a stock market broker prior to being elected and going to Congress, hence he had a comprehensive knowledge of the stock market and clearly had an interest in it.

Imagine you are Warren Buffett, and you can:

1). Get insider information to trade on it

2). Get a six-figure position after College.

3). After a few years, set up your own fund, getting money from wealthy family friends

4). Pay no dividends to investors and only put a hundred bucks of your own money into the fund

5). Let the mathematics of compounding work its magic as you bring in more institutional money

6). Become so connected Politically and connected on Wall Street that you can get special deals, which have practically no risk as you know bailouts are coming. For example, in the 2008 crisis, Berkshire owned stock valued at more than $13 billion in the top recipients of the TARP funds, and Berkshire had at least twice as much dependence on bailed-out banks as any other large investor.

7). Have billions of dollars on hand, remember you ain't paying any dividends to investors, ready for the inevitable economic recession to hit so that you can sweep up cheap assets.

8). Be holier-than-thou (i.e. calling derivatives "financial weapons of mass destruction" when, during the height of the 2008 crisis, Berkshire sold more than $2.5 billion worth of credit default swaps; OR what about Buffett's reputation as the saviour in the Great Recession when Berkshire is the majority owner of Moody's, who played a key role in inflating the crisis in 2008 - via their questionable debt and derivative ratings which inflated the mortgage and subprime market.

What about Buffett's status as the GOAT of Investing?

Billionaire Chamath Palihapitiya has even stated that Jeff Bezos is the best investor of our generation, not Warren Buffett.

Buffett has missed out on an entire raft of tech and Berkshire has underperformed the S&P 500 in recent years.

Also, he has been critical of Bitcoin, describing it as "rat poison squared"

Ultimately, Buffett is worth $73 billion, he doesn't need to have an in-depth understanding of new age tech.

Also, Buffett has a huge stake in Finance 1.0, why would he give props to Finance 2.0?

It's worth noting that Howard Buffett strongly supported the gold standard because he believed it would limit the ability of government to inflate the money supply and spend beyond its means.

His son Warren, however, hates gold. See the Cantillon Effect as to why:

Some have even argued that Buffett's success can be summarised by the following:

First Deals = Insider Information

Last Deals = Cantillon Effect

What are your thoughts?

Is it true... or false?

PATREON TO TIP OR ACCESS EXCLUSIVE CONTENT:

DISCLAIMER: NOT INVESTMENT ADVICE

Комментарии

0:00:23

0:00:23

0:35:14

0:35:14

0:32:36

0:32:36

0:01:32

0:01:32

0:28:44

0:28:44

0:00:59

0:00:59

0:26:23

0:26:23

0:00:45

0:00:45

4:33:49

4:33:49

0:04:08

0:04:08

0:08:37

0:08:37

0:03:06

0:03:06

0:05:28

0:05:28

0:05:20

0:05:20

1:33:30

1:33:30

0:07:15

0:07:15

0:06:20

0:06:20

0:05:23

0:05:23

0:00:45

0:00:45

0:08:46

0:08:46

0:01:49

0:01:49

0:08:59

0:08:59

0:01:19

0:01:19

0:04:17

0:04:17