filmov

tv

Intro to Managerial Accounting: An Intuitive Approach (Chapter 1)

Показать описание

Introduction to Managerial Accounting

Professor Savita Sahay

Chapter 1

TIME STAMPS

0:13 Four types of Accounting

0:37 Financial Accounting

2:24 Management Accounting

3:55 Financial vs. Managerial Accounting

6:02 Cost Accounting

7:11 Tax Accounting

7:42 Practice Examples

8:49 Strategy and Management Accounting

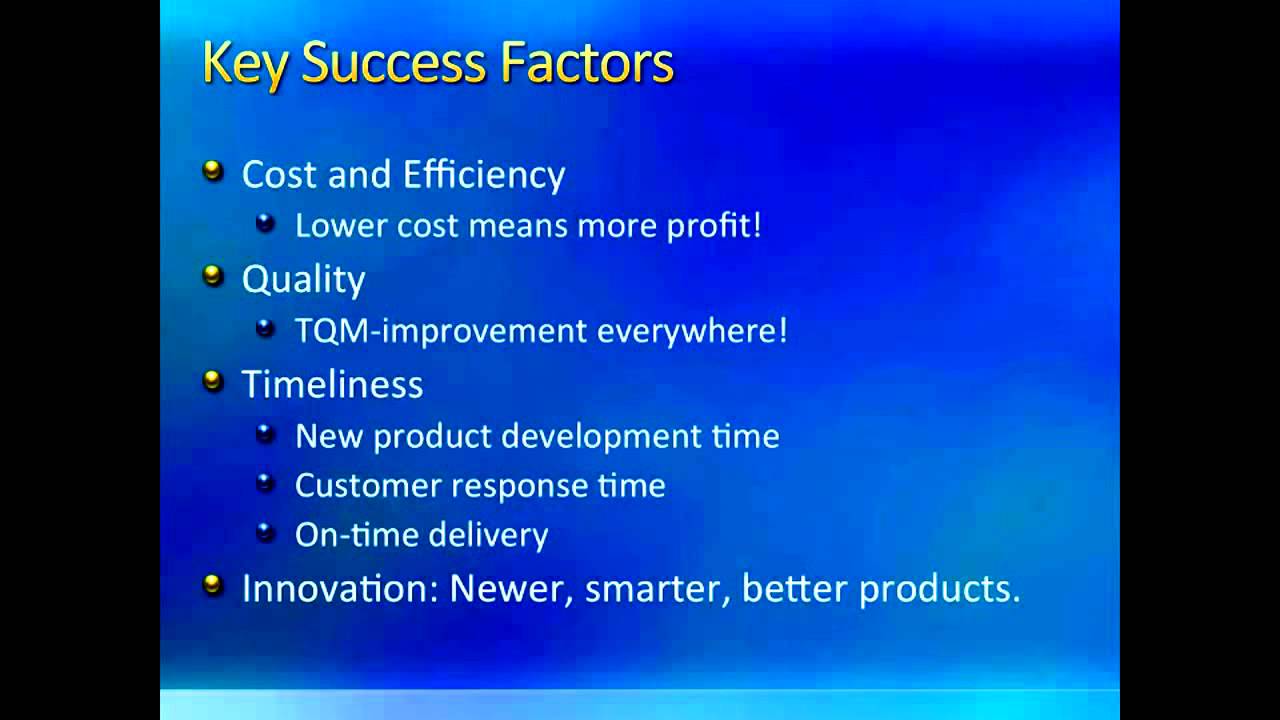

10:22 Key Success Factors

11:48 Value Chain

14:04 Supply Chain

14:45 How do managers make decisions?

16:30 Practice Examples

18:43 Professional Ethics

21:19 Resolution of Ethical Conflict

21:46 Practice Examples

There are four types of accounting. Financial accounting, management accounting, cost accounting, and tax accounting.

Financial accounting is designed to help external users, such as creditors, suppliers, investors, customers, government agencies, and labor unions make decisions. Several types of financial statements include the income statement, balance sheet, statement of cash flows, and statement of owner's equity (statement of retained earnings). Financial accounting abides by GAAP (generally accepted accounting principles) and auditors overseen by the PCAOB regularly review them to make sure they are following those rules. Finacial statements are put out on a yearly or quarterly basis.

Management accounting is designed to help internal users, such as managers, make important business related decisions. The goal of management accounting is to provide an information system that enables people inside an organization to make informed decisions, be more effective at their jobs, and improve the organization's performance. There are no preset rules to follow (unlike financial accounting, which follows GAAP), and reports can be produced on an hourly, daily, or monthly basis. Managerial accounting is NOT mandatory for companies to have.

Financial accounting takes more of a historical prospective while managerial accounting puts an emphasis on the future (i.e. trying to improve future performance). Financial accounting emphasizes verifiability (of transactions / events) while managerial accounting emphasizes planning and control.

Cost accounting provides information about all types of costs. It helps managers make better decisions. It can be used in conjunction with financial and managerial accounting. Lastly, tax accounting is designed to help determine how much money is owed to the government in taxes. The rules regarding taxes are set by the IRS (internal revenue service).

Strategy specifies how a company chooses to compete and be successful. There are two broad strategies - low price (which is of reasonable quality, but at a lower price) and price differentiation (which involves producing a unique, high quality product but at a premium price). There is no "best" strategy - it all depends on the company's strengths, resources, customers, competitors, and priorities.

Key success factors are cost and efficiency (lower cost leads to more profit), quality (TQM - total quality management), timeliness (creating new products on an expedient basis, responding to customers fast, and delivering items on the proper time), and innovation (creating newer, smarter, and better products).

The value chain is a sequence of business functions that add value to products / services. The value chain has 6 primary functions - (1) research and development (denoted R&D), (2) design of product, (3) production (4) marketing (5) distribution, and (6) customer service. The supply chain, on the other hand, describes the flow of goods, services, and information from the beginning (inception of product) to the end customer. A supply chain consists of suppliers, manufacturers, distributors, retailers, and consumers.

Managers make decisions by planning, which involves identifying alternatives, obtaining information, analyzing the acquired information and using it to make predictions, and then choosing the best alternative. A budget is a quantitative expression of a plan (i.e. how much money does management plan to spend on a given decision). They help communicate (in numbers) what companies want.

Professional ethics are very important, and unfortunately, the temptation to behave unethically is high. There are four guidelines issued by the IMA (institute of management accountants); competence, confidentiality, integrity, and credibility. To avoid ethical conflict, it is best to abide by the policies of the organization. If this fails, attempt discussing the issue with your supervisor.(assuming they are not involved). If all else fails, it is better to resign then to be caught in between a massive ethical scandal (or possibly a fraud) and face prison.

To receive additional updates regarding our library please subscribe to our mailing list using the following link:

Professor Savita Sahay

Chapter 1

TIME STAMPS

0:13 Four types of Accounting

0:37 Financial Accounting

2:24 Management Accounting

3:55 Financial vs. Managerial Accounting

6:02 Cost Accounting

7:11 Tax Accounting

7:42 Practice Examples

8:49 Strategy and Management Accounting

10:22 Key Success Factors

11:48 Value Chain

14:04 Supply Chain

14:45 How do managers make decisions?

16:30 Practice Examples

18:43 Professional Ethics

21:19 Resolution of Ethical Conflict

21:46 Practice Examples

There are four types of accounting. Financial accounting, management accounting, cost accounting, and tax accounting.

Financial accounting is designed to help external users, such as creditors, suppliers, investors, customers, government agencies, and labor unions make decisions. Several types of financial statements include the income statement, balance sheet, statement of cash flows, and statement of owner's equity (statement of retained earnings). Financial accounting abides by GAAP (generally accepted accounting principles) and auditors overseen by the PCAOB regularly review them to make sure they are following those rules. Finacial statements are put out on a yearly or quarterly basis.

Management accounting is designed to help internal users, such as managers, make important business related decisions. The goal of management accounting is to provide an information system that enables people inside an organization to make informed decisions, be more effective at their jobs, and improve the organization's performance. There are no preset rules to follow (unlike financial accounting, which follows GAAP), and reports can be produced on an hourly, daily, or monthly basis. Managerial accounting is NOT mandatory for companies to have.

Financial accounting takes more of a historical prospective while managerial accounting puts an emphasis on the future (i.e. trying to improve future performance). Financial accounting emphasizes verifiability (of transactions / events) while managerial accounting emphasizes planning and control.

Cost accounting provides information about all types of costs. It helps managers make better decisions. It can be used in conjunction with financial and managerial accounting. Lastly, tax accounting is designed to help determine how much money is owed to the government in taxes. The rules regarding taxes are set by the IRS (internal revenue service).

Strategy specifies how a company chooses to compete and be successful. There are two broad strategies - low price (which is of reasonable quality, but at a lower price) and price differentiation (which involves producing a unique, high quality product but at a premium price). There is no "best" strategy - it all depends on the company's strengths, resources, customers, competitors, and priorities.

Key success factors are cost and efficiency (lower cost leads to more profit), quality (TQM - total quality management), timeliness (creating new products on an expedient basis, responding to customers fast, and delivering items on the proper time), and innovation (creating newer, smarter, and better products).

The value chain is a sequence of business functions that add value to products / services. The value chain has 6 primary functions - (1) research and development (denoted R&D), (2) design of product, (3) production (4) marketing (5) distribution, and (6) customer service. The supply chain, on the other hand, describes the flow of goods, services, and information from the beginning (inception of product) to the end customer. A supply chain consists of suppliers, manufacturers, distributors, retailers, and consumers.

Managers make decisions by planning, which involves identifying alternatives, obtaining information, analyzing the acquired information and using it to make predictions, and then choosing the best alternative. A budget is a quantitative expression of a plan (i.e. how much money does management plan to spend on a given decision). They help communicate (in numbers) what companies want.

Professional ethics are very important, and unfortunately, the temptation to behave unethically is high. There are four guidelines issued by the IMA (institute of management accountants); competence, confidentiality, integrity, and credibility. To avoid ethical conflict, it is best to abide by the policies of the organization. If this fails, attempt discussing the issue with your supervisor.(assuming they are not involved). If all else fails, it is better to resign then to be caught in between a massive ethical scandal (or possibly a fraud) and face prison.

To receive additional updates regarding our library please subscribe to our mailing list using the following link:

Комментарии

0:05:54

0:05:54

0:09:34

0:09:34

0:20:23

0:20:23

0:15:32

0:15:32

0:07:10

0:07:10

9:59:29

9:59:29

0:07:43

0:07:43

0:20:47

0:20:47

2:11:52

2:11:52

0:16:36

0:16:36

0:13:03

0:13:03

0:04:48

0:04:48

0:37:32

0:37:32

0:19:27

0:19:27

0:14:13

0:14:13

0:09:44

0:09:44

1:17:54

1:17:54

0:07:08

0:07:08

0:45:07

0:45:07

0:01:38

0:01:38

0:33:54

0:33:54

0:28:47

0:28:47

0:02:21

0:02:21

0:02:51

0:02:51