filmov

tv

3 Major Questions Around Evergrande's Debt And China's Economy That Remain Unanswered | Forbes

Показать описание

In the past month, Chinese property developer Evergrande has dominated financial headlines for being over $300 billion in debt. Many media reports have made parallels to Lehman Brothers role in the 2008 financial crisis. In this episode of Money Always Talks, we take a look at how things at Evergrande got this bad and what greater questions the saga raises about China's economic growth.

Stay Connected

Forbes covers the intersection of entrepreneurship, wealth, technology, business and lifestyle with a focus on people and success.

Stay Connected

Forbes covers the intersection of entrepreneurship, wealth, technology, business and lifestyle with a focus on people and success.

Chinese property giant Evergrande has a huge debt problem – here's why you should care

China’s Evergrande: What Are the Implications?

Chinese President Xi Jinping confronts Justin Trudeau at G20 | USA TODAY #Shorts

Evergrande crisis: China's central bank urges financial institutions to support property market

Evergrande: the end of China's property boom | FT Film

China To Clamp Down On Banks While Evergrande Misses Another Bond Payment

China’s Looming Crises | CNBC Marathon

Why China's Economy is Finally Slowing Down

Is China Evergrande a Contagion Event? | The Big Conversation | Refinitiv

Overrated or Underrated: Anime

What China's Slowdown Means for Us All

Everything You Need To Know About the Chinese Evergrande Crisis (So Far) - How Money Works

Trading Evergrande Crisis: How to Trade Fear in the Market using Options | Evergrande Crisis Impact

The Consequences of China's Slowdown

💥 ARK Invest's HUGE Trades Around the Collapse of Evergrande Group

China's Lehman moment? How Evergrande crisis may impact India and the world

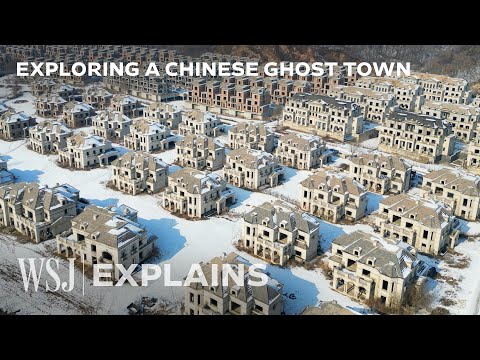

Inside a Chinese Ghost Town of Abandoned Mansions | WSJ

H.K. SFC CEO: Much of Climate Finance Landscape Is About China

World’s Most Indebted Developer Has Golden Week Sales Bonanza

What to Watch for When in China’s Markets

China's Evergrande's Fall & What it Means Now

China under pressure: Evergrande debt crisis, conflict with U.S.

Live Q&A: Adapt or resist? Where is China's economy headed in 2024? | DW News

Evergrande Crisis | Chinese Stock Market Collapse w/ David Stein (TIP384)

Комментарии

0:08:59

0:08:59

1:01:35

1:01:35

0:00:43

0:00:43

0:04:43

0:04:43

0:22:24

0:22:24

0:09:05

0:09:05

0:33:49

0:33:49

0:20:18

0:20:18

0:12:33

0:12:33

0:00:55

0:00:55

0:09:55

0:09:55

0:10:00

0:10:00

0:05:53

0:05:53

0:15:15

0:15:15

0:15:25

0:15:25

0:06:33

0:06:33

0:05:14

0:05:14

0:15:28

0:15:28

0:01:34

0:01:34

0:05:40

0:05:40

0:26:32

0:26:32

0:15:14

0:15:14

0:50:52

0:50:52

1:05:07

1:05:07