filmov

tv

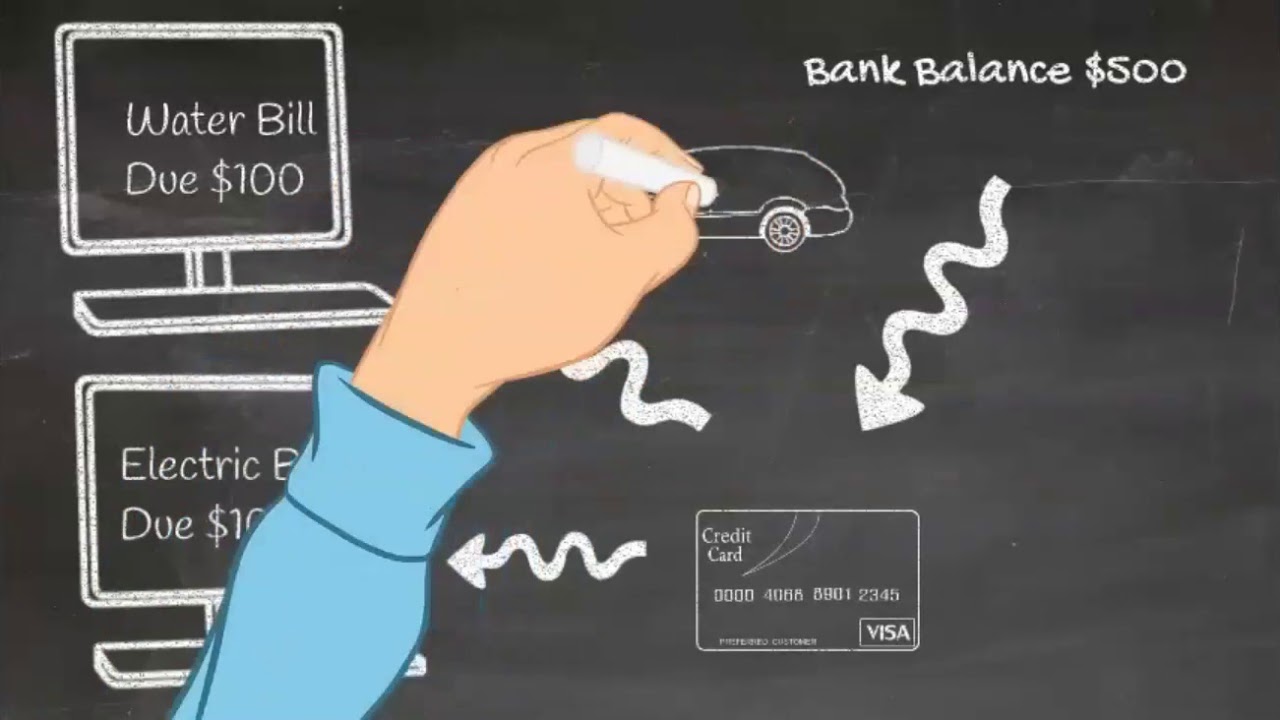

Step by Step ~ Part 1 What is Velocity Banking

Показать описание

Creating a budget, Velocity Banking, Infinite Banking, Wealth Creation

Ready to become your own banker?

Step by Step

Ready to become your own banker?

Step by Step

ETH Staking | Part 4 | Tapswap Code

SUB] 21 days Closer Step Part5

How To French Braid Step By Step For Beginners - 1 Of 2 Ways To Add Hair To The Braid (PART 1) [CC]

'Step By Step' Lyric Video | Spellbound Sing Along | Netflix After School

Step By Step | How To Start | TEMPORARY DREADLOCKS | Beginners Tutorial (PART 1)

quick DIY part line highlights | step by step

How to find your style (Step-by-Step Guide) Part 1

Step by Step | MUET Speaking | Part 1 - Individual Presentation | New Format

My Secret Trading Strategy (Part 1) | Step-by-Step Guide

#wood structure || Full step by step🪵🔨🪚.part 3

Bankdrücken (Bench Press) | Technik Step by Step - Part 1

A Single Step. Part 4. Venture II visits Ireland and Scotland.

Basic Mens Haircut | Step by Step Guide

EKG like a BOSS Part 2 - The 5 Step Method

How to knit a Baby V-Neck Raglan Cardigan, step by step - Part 2

I Fell In Love With My Step Brother Part 9 | Berry Avenue Roleplay Story

Your First Custom: Drawing the Face Step-by-Step [PART 2]

How To Cook Your Thanksgiving Turkey Step By Step Part 1🦃

Easiest Solve For a Rubik's Cube | Beginners Guide/Examples | STEP 1

A Step-by-Step Guide to the Catholic Mass

A Single Step. Part 12. Venture Visits the Inside Passage and SE Alaska.

DIY PUFF SLEEVE BUSTIER MIDI DRESS - COTTAGECORE DRESS - Step by step sewing tutorial

How To Install Epoxy Floors In A 2000 sq ft Home | Step By step Explained | PART 1

How to knit a Baby V-Neck Raglan Cardigan, step by step - Part 1

Комментарии

0:02:05

0:02:05

![SUB] 21 days](https://i.ytimg.com/vi/VXP-imBjzMM/hqdefault.jpg) 0:12:15

0:12:15

0:03:20

0:03:20

0:03:33

0:03:33

0:13:49

0:13:49

0:09:06

0:09:06

0:00:46

0:00:46

0:13:28

0:13:28

0:17:04

0:17:04

0:00:16

0:00:16

0:06:33

0:06:33

1:01:13

1:01:13

0:15:14

0:15:14

0:04:18

0:04:18

0:25:48

0:25:48

0:16:46

0:16:46

0:11:22

0:11:22

0:22:43

0:22:43

0:07:59

0:07:59

0:31:08

0:31:08

1:04:58

1:04:58

0:18:42

0:18:42

0:35:07

0:35:07

0:32:06

0:32:06