filmov

tv

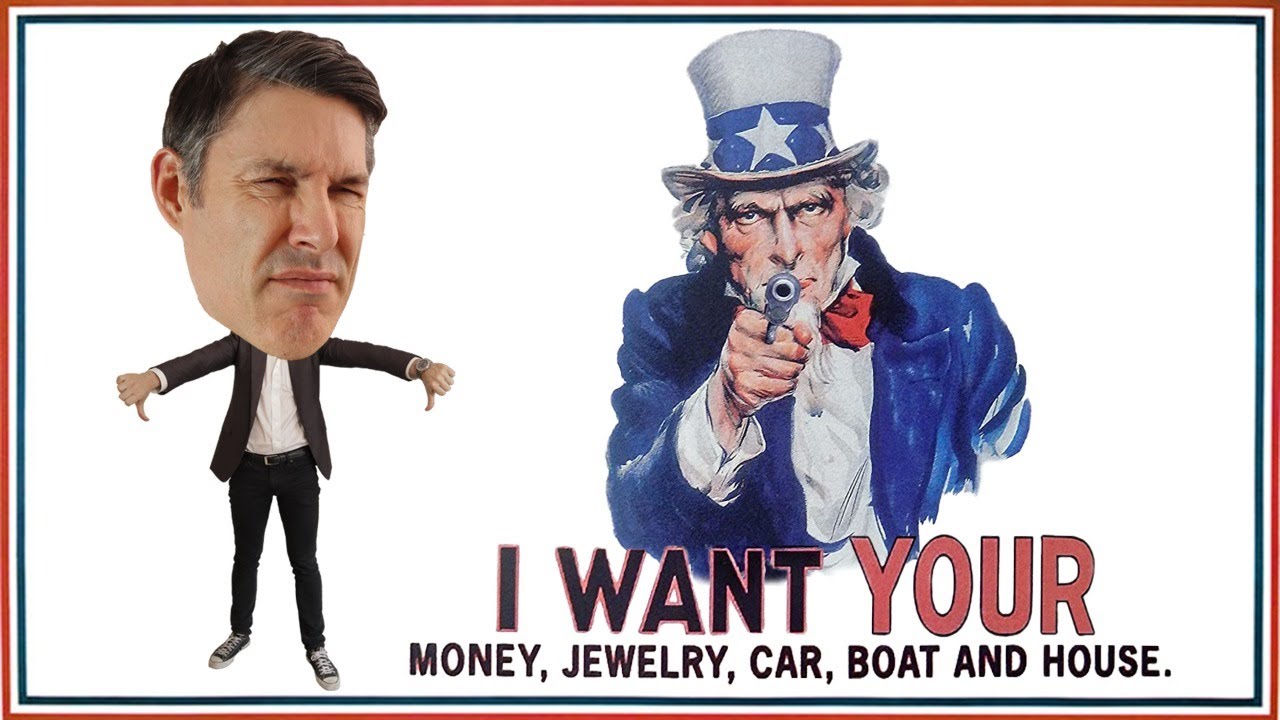

The Government Is Going To STEAL YOUR MONEY! (Here's How)

Показать описание

These are the 👉 DIRTY LITTLE SECRETS THEY DON'T WANT YOU TO KNOW! 👈 The government is over 25 trillion dollars in debt, a truly astonishing amount. The only way to deal with the debt load is to default, use inflation, steal from you, or a combination of both! But the question is how will the do it? If we know their tactics we can better prepare for the future. YOU can take legal steps now to make sure the government is stealing as little of your purchasing power and wealth as possible. This is vital information YOU CAN'T AFFORD TO MISS!!

In this video I reveal the following:

1. How the government will take your assets.

2. How the government will pay you less.

3. How the government will tax you more!!

For more content that'll help you build wealth and thrive in a world of out of control central banks and big governments check out the videos below! 👇

Do you wanna see another video as incredible as this?

Stay tuned every week for new content!

#ShockingInsights #BePrepared #TaxScam

In this video I reveal the following:

1. How the government will take your assets.

2. How the government will pay you less.

3. How the government will tax you more!!

For more content that'll help you build wealth and thrive in a world of out of control central banks and big governments check out the videos below! 👇

Do you wanna see another video as incredible as this?

Stay tuned every week for new content!

#ShockingInsights #BePrepared #TaxScam

The Government Is Never Going To Fix Your Life!

Will the federal government fall today? What about next week? | The Big Story

How is the government going to help businesses with their energy bills?

Rand Paul: The Government is Going to Keep SPYING ON YOU

Varney: NYC will have a ‘chaotic government’ for another year #shorts

Where Are Laid Off Tech Employees Going? | CNBC Marathon

The Government Is Never Going To Fix Your Life!

FBI: The MAGA Maniacs Who Tried To Overthrow The Government Are Going To Pay

The Government Is Going to Shut Down Again (and That's Bad)

We're going to have a referendum, here's how the government have made it happen | ABC News

The U.S. Just Got Bigger

If Trump is elected again, the government is going to break down: David Frum

“He’s Lived A Complete LIE” | Question Marks About Keir Starmer's Past

When is the Government going to take responsibility for policing failures (29th June 2022)

'It is a joke': Joe calls out double standard as Trump gets a 'free pass' on pol...

Lightning Round: The government is going to stop the Kroger-Albertsons merger, says Jim Cramer

#Warren: Who’s going to pay to run this #government

Economist: NZ's private debt more worrying than Govt's borrowing | Q+A 2024

Short-term funding bill unveiled | What to know about possible government shutdown

President Ruto: The government is going to get to the bottom of what happened in Shakahola

Is the government shutdown going to affect the USCIS?

Spending deal averts a possible federal shutdown and funds the government into December

#Shorts | 'INDIA alliance is going to form the government' | Congress | Rahul Gandhi | Mod...

Rep. Dan Goldman: I can't take $50 as a congressman, SCOTUS justices are going on $500,000 vaca...

Комментарии

0:00:21

0:00:21

0:23:12

0:23:12

0:02:31

0:02:31

0:16:52

0:16:52

0:01:00

0:01:00

0:41:28

0:41:28

0:00:21

0:00:21

0:13:01

0:13:01

0:04:47

0:04:47

0:00:47

0:00:47

0:01:00

0:01:00

0:08:45

0:08:45

0:11:25

0:11:25

0:00:35

0:00:35

0:00:59

0:00:59

0:03:17

0:03:17

0:00:46

0:00:46

0:10:43

0:10:43

0:01:39

0:01:39

0:06:56

0:06:56

0:08:21

0:08:21

0:00:26

0:00:26

0:00:53

0:00:53

0:00:51

0:00:51