filmov

tv

Standard Normal Distribution and Z-Score With Python On Live Data | 56/100 Days of Python Algo Trad.

Показать описание

Standard Normal Distribution and Z-Score With Python On Live Data | 56/100 Days of Python Algo Trading

In Day 56 of "100 Days of Python Algo Trading," we delve into the practical applications of the standard normal distribution and Z-scores using Python, with a focus on live stock data. This session will cover the theoretical aspects of standardization, the benefits and drawbacks of this approach, and hands-on examples of data analysis including fetching, plotting, and statistical calculations for stock data.

What You'll Learn:

Introduction (Starts at 00:00:00): Quick overview of today's session and its importance in financial analytics and trading strategies.

Plan of Action (Starts at 00:00:32): Outline of the steps we'll take during the tutorial, from data fetching to detailed statistical analysis.

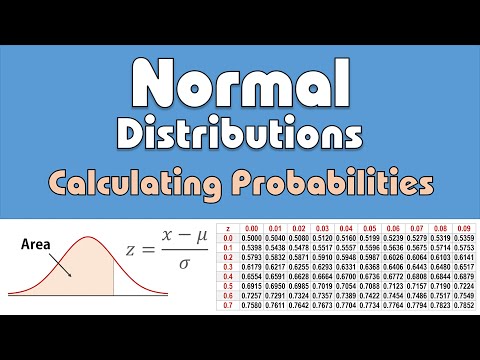

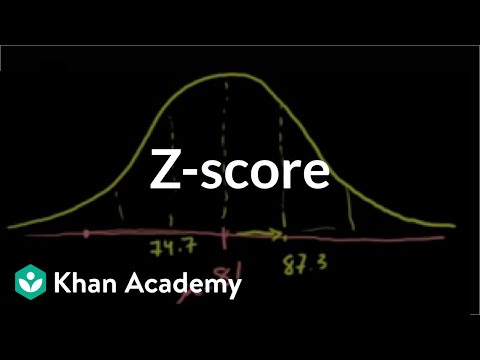

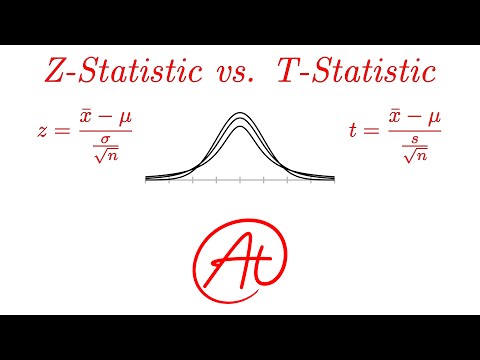

Revision of the Standard Normal Distribution (Starts at 00:01:20): A brief recap of what the standard normal distribution is and why it is pivotal in statistical analysis, particularly in the context of financial data.

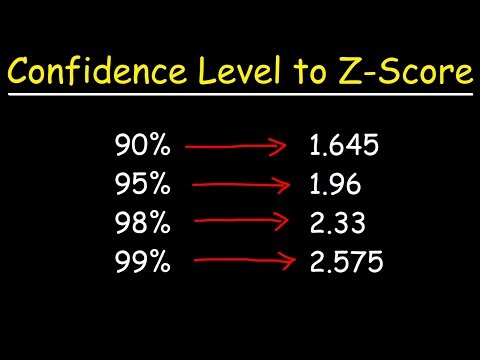

Pros and Cons of Standardizing Data (Starts at 00:03:15): Discussion on the advantages and limitations of transforming data into a standard normal format, helping traders understand when and why to use this method.

Stock Data Analysis: Fetching 3 Years, Histogram Plotting, Basic Parameters, and CDF Calculation (Starts at 00:08:12): Step-by-step demonstration on how to:

Fetch three years of stock data using Python.

Plot histograms to visualize the distribution of stock prices.

Calculate basic statistical parameters (mean, median, standard deviation).

Compute and plot the cumulative distribution function (CDF) for further insights into the data’s distribution.

Engage with Us:

Interactive Tutorial: Follow along with the provided Python code to apply these concepts to live stock data.

Ask Questions: Unsure about a concept or need clarification on a Python function? Leave a comment below, and we’ll help out.

Subscribe for More: Keep up with our series to enhance your skills in algorithmic trading by subscribing and activating notifications.

Join us as we break down complex statistical concepts into practical tools that can be applied directly to enhance your trading decisions and risk management strategies. Whether you're just starting out or looking to deepen your understanding of financial data analysis, this session will provide valuable insights and hands-on skills.

Timestamps:

00:00:00 - Introduction

00:00:32 - Plan of Action

00:01:20 - Revision of the Standard Normal Distribution

00:03:15 - Pros and Cons of Standardizing Data

00:08:12 - Stock Data Analysis: Fetching, Histogram Plotting, Basic Parameters, and CDF Calculation

This session is designed to equip you with the knowledge to transform theoretical statistical concepts into actionable insights using Python, helping you navigate the complexities of financial markets with greater confidence.

Connect with us

YouTube

Instagram

Facebook

X ( twitter )

LinkedIn

Discord

Telegram

WhatsApp

GitHub

Tags

python for beginners

python for finance

python for trading

python algo trading tutorial

AI in trading

machine learning for beginners

machine learning algorithms for trading

deep learning for finance

algorithmic trading strategies

how to build a trading bot with python

trading bot tutorial

algo trading for beginners

machine learning for beginners course

AI for beginners course

python for algo trading beginners

machine learning for algo trading strategies

how to build an AI trading bot with python

Python mini projects

Data science projects

Data analysis projects

Algotrading projects

#standardnormaldistribution #normaldistribution #yfinance #livedata #livetradedata #trading #optionstraining #stockoptions #stock #python #pythonprogramming #pythontrading #pythonalgotrading #artificialintelligence #AI #machinelearning #ML #deeplearning #algorithms #algotrading #algorithmictrading #trading #finance #cryptocurrency #bitcoin #option #optiontrading #optionvolatility #optiontrading #trading #tradingstrategies #quantitativetrading #quantitativeanalysis

In Day 56 of "100 Days of Python Algo Trading," we delve into the practical applications of the standard normal distribution and Z-scores using Python, with a focus on live stock data. This session will cover the theoretical aspects of standardization, the benefits and drawbacks of this approach, and hands-on examples of data analysis including fetching, plotting, and statistical calculations for stock data.

What You'll Learn:

Introduction (Starts at 00:00:00): Quick overview of today's session and its importance in financial analytics and trading strategies.

Plan of Action (Starts at 00:00:32): Outline of the steps we'll take during the tutorial, from data fetching to detailed statistical analysis.

Revision of the Standard Normal Distribution (Starts at 00:01:20): A brief recap of what the standard normal distribution is and why it is pivotal in statistical analysis, particularly in the context of financial data.

Pros and Cons of Standardizing Data (Starts at 00:03:15): Discussion on the advantages and limitations of transforming data into a standard normal format, helping traders understand when and why to use this method.

Stock Data Analysis: Fetching 3 Years, Histogram Plotting, Basic Parameters, and CDF Calculation (Starts at 00:08:12): Step-by-step demonstration on how to:

Fetch three years of stock data using Python.

Plot histograms to visualize the distribution of stock prices.

Calculate basic statistical parameters (mean, median, standard deviation).

Compute and plot the cumulative distribution function (CDF) for further insights into the data’s distribution.

Engage with Us:

Interactive Tutorial: Follow along with the provided Python code to apply these concepts to live stock data.

Ask Questions: Unsure about a concept or need clarification on a Python function? Leave a comment below, and we’ll help out.

Subscribe for More: Keep up with our series to enhance your skills in algorithmic trading by subscribing and activating notifications.

Join us as we break down complex statistical concepts into practical tools that can be applied directly to enhance your trading decisions and risk management strategies. Whether you're just starting out or looking to deepen your understanding of financial data analysis, this session will provide valuable insights and hands-on skills.

Timestamps:

00:00:00 - Introduction

00:00:32 - Plan of Action

00:01:20 - Revision of the Standard Normal Distribution

00:03:15 - Pros and Cons of Standardizing Data

00:08:12 - Stock Data Analysis: Fetching, Histogram Plotting, Basic Parameters, and CDF Calculation

This session is designed to equip you with the knowledge to transform theoretical statistical concepts into actionable insights using Python, helping you navigate the complexities of financial markets with greater confidence.

Connect with us

YouTube

X ( twitter )

Discord

Telegram

GitHub

Tags

python for beginners

python for finance

python for trading

python algo trading tutorial

AI in trading

machine learning for beginners

machine learning algorithms for trading

deep learning for finance

algorithmic trading strategies

how to build a trading bot with python

trading bot tutorial

algo trading for beginners

machine learning for beginners course

AI for beginners course

python for algo trading beginners

machine learning for algo trading strategies

how to build an AI trading bot with python

Python mini projects

Data science projects

Data analysis projects

Algotrading projects

#standardnormaldistribution #normaldistribution #yfinance #livedata #livetradedata #trading #optionstraining #stockoptions #stock #python #pythonprogramming #pythontrading #pythonalgotrading #artificialintelligence #AI #machinelearning #ML #deeplearning #algorithms #algotrading #algorithmictrading #trading #finance #cryptocurrency #bitcoin #option #optiontrading #optionvolatility #optiontrading #trading #tradingstrategies #quantitativetrading #quantitativeanalysis

Комментарии

0:06:57

0:06:57

0:51:03

0:51:03

0:05:21

0:05:21

0:14:08

0:14:08

0:07:09

0:07:09

0:19:07

0:19:07

0:04:51

0:04:51

0:07:48

0:07:48

0:10:59

0:10:59

0:12:34

0:12:34

0:11:59

0:11:59

0:13:09

0:13:09

0:08:21

0:08:21

0:03:16

0:03:16

0:07:26

0:07:26

0:06:16

0:06:16

0:13:47

0:13:47

0:08:50

0:08:50

0:04:08

0:04:08

0:05:05

0:05:05

0:05:15

0:05:15

0:19:48

0:19:48

0:11:05

0:11:05

0:10:55

0:10:55